Article

Crypto-queues continued: Shoppers look for cheaper ways to make crypto payments

In our previous post , we have discussed and illustrated the relationship between the recent changes in Bitcoin’s mempool size (by months) and the perception regarding the crypto-payments potential to get ahead of the conventional methods (e.g., credit cards, remittance, etc.). Before jumping on a new topic in the series, there are more words to be said regarding the effects of Bitcoin mempool on the crypto-shopping experiences.

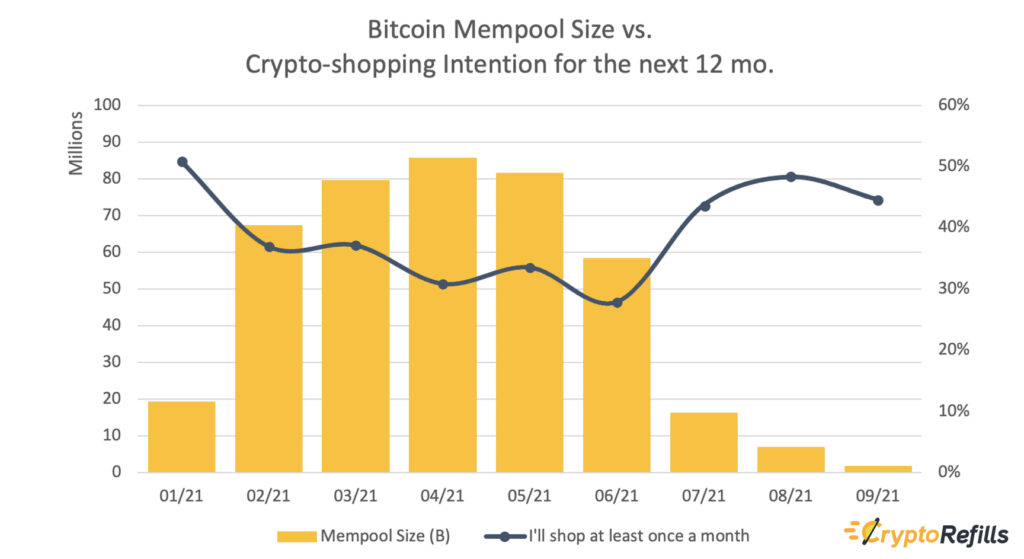

From the beginning of the year, crypto-consumers are asked how likely and how often they’ll be doing crypto-shopping within the next 12 months. The collected answers were drawn together with the Bitcoin mempool’s time-averaged volume (per number of pending transactions). The resulting graph below reveals a firm inverse correlation between the volume of the transactions waiting in the queue and the crypto-shoppers’ likelihood of using crypto to pay for the goods and services they need in the near future. From a customer experience point of view, this is, of course, not a surprise. Nevertheless, such a bold correlation is noteworthy. When the mempool started bulging with a large stream of incoming transaction requests in February 2021, crypto-shoppers started to face longer pre-processing delays and higher costs. This almost immediately affected their will to repeat their usual purchases or making new ones in the not-too-distant future.

The chart shows that the surge in mempool becomes clearly visible in February and continues until late June when the congestion started to resolve. The chart also clarifies that within the same time period, namely between February and June, the intention of current crypto-shoppers regarding purchasing or repurchasing anything by paying in crypto falls significantly. Yet after June, the demand restored smashingly fast, which indicates a deep-rooted essential need for crypto-payments within daily life and – presumably – in commercial activities. Before February, the average share of crypto-shoppers who claim to make future purchases at least once a month constituted slightly more than half of all. Although the rate dropped just below 30% in June, it quickly rose to where it was prior to February. Let us present a bonus bit of insight: Within the same period, those claiming that they’ll no more do crypto-shopping never increased at all!

On the other hand, the overload in Bitcoin mempool did not affect many of those crypto-shoppers or could not hinder them from looking for other payment options for their upcoming purchases. The reasons behind this fact can be more important than you think. First of all, as our latest annual report revealed, many people in struggling economies earn some crypto-income in exchange for providing online services at varying (mostly minor) services, hence relying on crypto to survive. Second, many crypto-shoppers – especially more experienced ones – already use cryptocurrencies other than Bitcoin for shopping purposes due to cheaper and faster transaction possibilities. So, they did not face such issues or experienced much smaller difficulties. Litecoin (LTC) for example is indeed a cheaper (i.e., virtually no fees) and very fast crypto-shopping experience.

But that’s not the entire story; there is one more secret that the expert shoppers usually rely on: the layer-2 solutions and scalability networks. These systems are designed for cheaper and faster crypto transfers and micropayments either by requiring notably fewer operations from the nodes in the blockchain of interest or partly being processed “off-chain”. There are now more than a few options for shoppers, depending on the currency (or token) they want to use in their payments. While The Lightning Network serves Bitcoin users and is seeing increasing adoption, Polygon (formerly MATIC), Avalanche C-Chain, Fantom and others are fast and cheap options for transferring Ethereum and the major stablecoins.. If you don’t yet know what they are, how they work, or which one suits youyour needs best , don’t panic. We will soon be discussingstablecoins and scalability solutions in depth.

Stay crypto-tuned!

Umut Can Çabuk

CryptoRefills.Labs