Article

How the mempool affects consumer spending of crypto

Overcrowded queues do not merely affect the customers at the airports, malls, and state departments but also annoy the crypto-consumers, who pay for goods and services online via their favorite cryptocurrencies. Our latest annual report already revealed that the crypto-consumers, especially those who prefer Bitcoin, either have to wait in the transactions queue for a quite long time or must fork out the dough to guarantee their transactions when there is high demand for such transactions on the blockchain. Although it does not happen always, it is apparently a large barrier to the wider adoption of crypto-shopping habits by online shoppers. The distributed waiting list of the Bitcoin network, called the “mempool”, is quite volatile, and the average fees that must be paid for a typical Bitcoin transfer change by the time. This also changes the real cost of making payments in crypto. An increasing pattern is observable throughout the years, but the change is definitely not linear. In this post, we present our recent analysis that reveals the correlation between the size of the Bitcoin mempool (in Bytes) and the crypto-consumers’ attitude towards crypto-shopping.

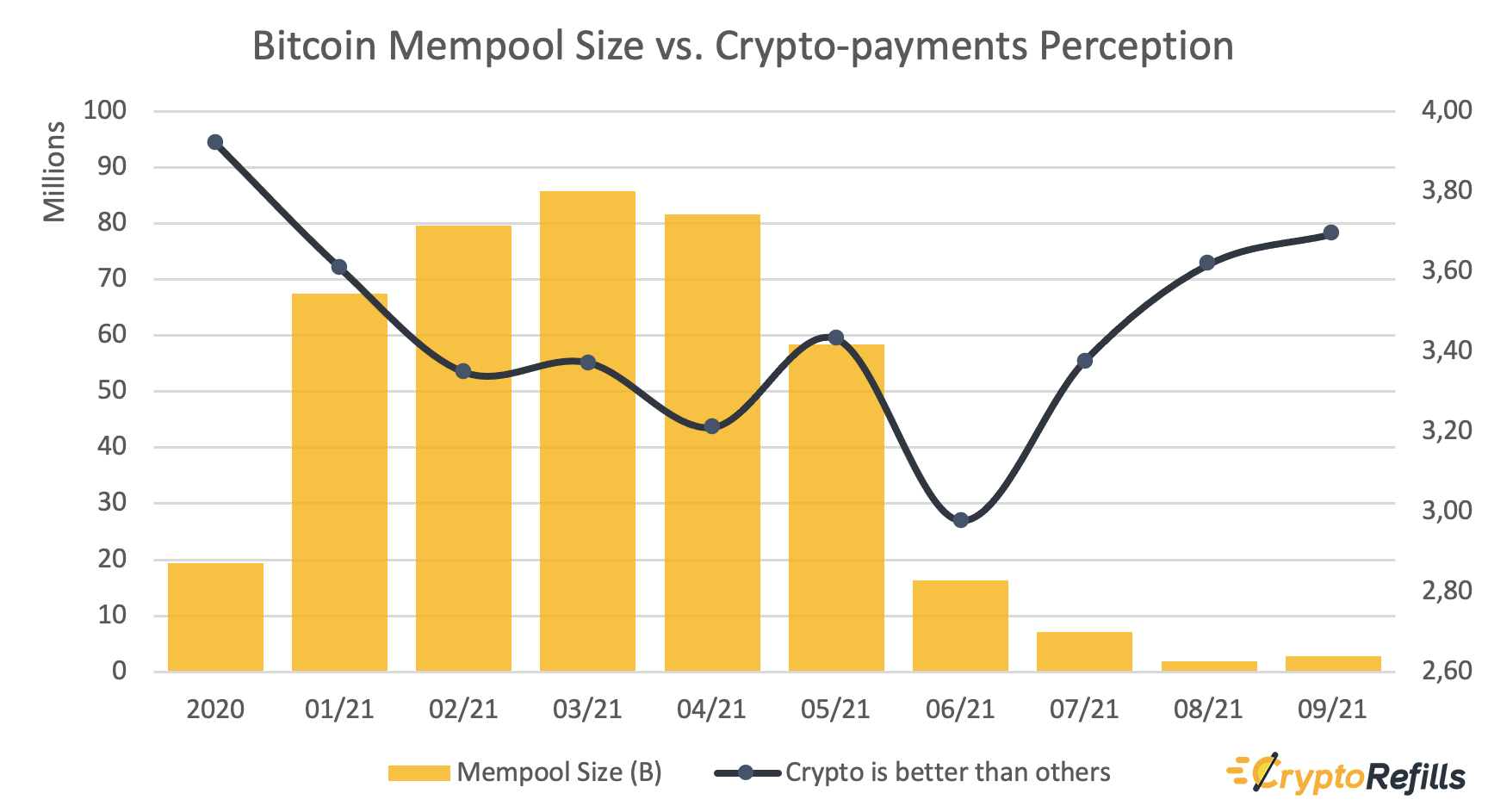

Our findings are demonstrated in the attached chart, where the mempool size is given in bytes on the left Y-axis, and the crypto-shoppers’ agreement with the given statements (“paying with crypto is better than other options” and “transaction fees are too high”) are given in 5-point Likert scale (‘1’ being the lowest and ‘5’ being the highest) on the right Y-axis. The X-axis gives the months except for the first marker that shows the mean average of the entire 2020. The mempool data is obtained from blockchain.com.

Obvious from the chart, when the mempool starts piling up due to high demand (as of the beginning of 2021), crypto-shoppers’ agreement with the idea that paying for goods and services in crypto is better than other payment methods starts decreasing drastically. Until end of May, things did no go any better in this perspective, even though the crazy increase in Bitcoin (and many other altcoin’s) prices were seen as positive in parts of the community. After June, the mempool relaxed a significantly, so as the fee/delay pressure on crypto-shoppers.

An overloaded mempool usually results in delayed transactions, if not more expensive. This can reach to certain degrees that no transaction ever completes unless an excessive fee is deducted, which makes crypto-shopping less feasible. Crypto-shopping is not just another form of online payments; it is more of a vital requirement for many people and small businesses in hardship (e.g., related to un/under-banking conditions), as revealed by our 2021 Consumer Report. Bitcoin fans, and more in general shoppers that prefer Bitcoin as a currency should definitely consider using the Lightning Network. If you are unaware of how Lightning Network works or how to use it to buy products and services you can read more here. Another option to reduce transaction queues when the grows is to use other cryptocurrencies with lesser (even nonnegligible) transaction fees, such as Litecoin and Dash.

Although our question does not specifically target Bitcoin users, it is still the predominant currency used in crypto-shopping; therefore, any dissatisfaction regarding Bitcoin affects the general crypto-shopping perception. But as everything in the blockchain industry, things change and evolve very rapidly. For example Lightning Network used to be “an expert only” technology but now is becoming very easy to use and is seeing much bigger adoption. “Queues” and fees also affect the Ethereum network. So for those who prefer paying with Eth or stablecoins, Scalability and Layer 2 solutions are becoming also available for ERC20 tokens, allowing to users to shop with stablecoins (USDC, USDT, DAI) with almost no fees and immediate transactions.

Stay crypto-tuned!

Umut Can Çabuk

CryptoRefills.Labs