Research

Shopping with stablecoins

In this article, we will share some of our most recent findings concerning the use of stablecoins for purchasing goods and services. If you are not quite sure how stablecoins work, don’t panic, we will first briefly explain what stablecoins exactly are and how they work. We will then explain the main issues related to the use of stablecoins for shopping and the differences between shopping with Bitcoin (and other cryptocurrencies). Lastly, we will describe some solutions that we have adopted to improve the shopping experience with stablecoins, also sharing some of our data on the potential for such solutions. Although this article is a stand-alone document, the readers are highly encouraged to read the consumer report published by CryptoRefills in May 2021 [1] to get a better understanding of crypto-shopping aspects in the crypto world as well as the choices and behaviors of crypto-shoppers.

What are stablecoins, and how do they work

It is out of scope of this article to provide a detailed description of stablecoins and details of their financial and technical mechanics. Keeping things simple, stablecoins are a special class of crypto assets where the price is designated to be pegged to the value of a fiat currency (or another asset), such as the US Dollar or Euro. This means, unlike most cryptocurrencies whose USD or Euro prices change in relation to the market conditions (i.e., demand and supply), stablecoins “tend” (at least “should”) not vary when the market goes up or down.

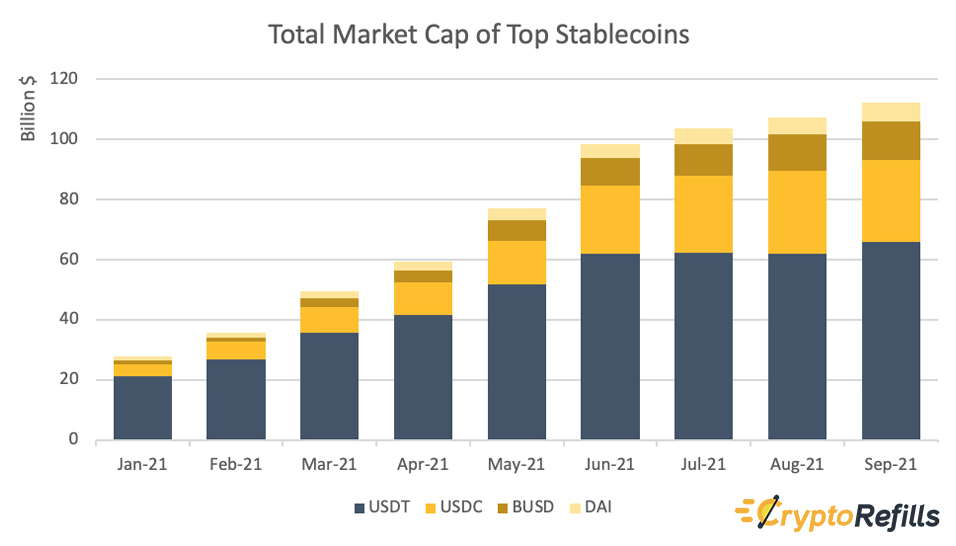

As of today, the top five major stablecoins in terms of their market capitalization are USDT, USDC, BUSD, and DAI, in the given order. Their evolution for the past year is shown in the chart below, as of the first day of each month [2].

The major stablecoins were born as ERC20 tokens on the Ethereum network. Then, following some innovations in the blockchain space, other equivalent stablecoins were made available to be transacted on other blockchains. Today, it is possible to transact stablecoins on many major blockchains and scalability solutions, such as Binance Smart Chain, Tron, Avalanche, Solana, Matic/Polygon, Fantom, Optimism, and many others. Furthermore, it is also possible to bridge stablecoins between these networks using specific smart contracts and DeFi or exchange services.

2. Understanding stablecoin transaction costs and speed

There is usually a cost for transferring cryptocurrencies between wallets (so as users). This cost, or let’s say fee, is to reward the miners (or the nodes) for ensuring the transaction is made correct and for maintaining the integrity of the ledger. Furthermore, if the transacted token is not the native token of the preferred blockchain, the fee is even higher because of the use of the smart contract related to such token. For example, transacting ETH over the Ethereum network is cheaper than transacting USDT or DAI over the same network.

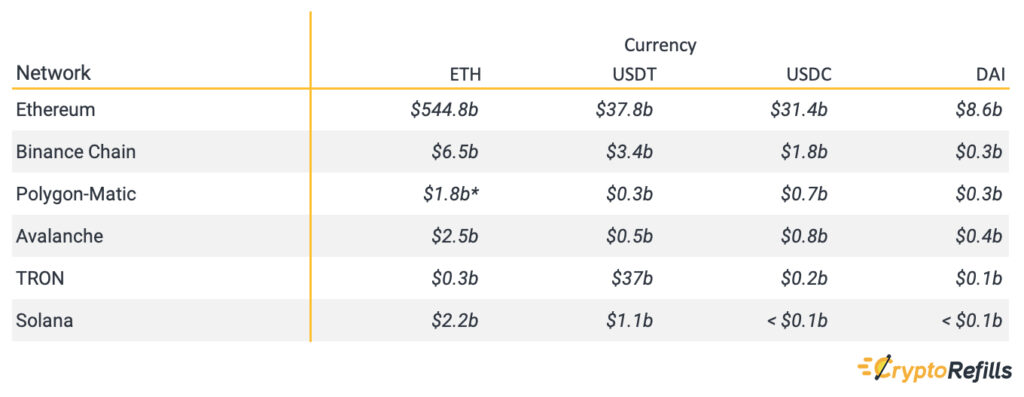

As mentioned earlier, it is possible to transfer stablecoins across different compatible blockchains (e.g., Binance Smart Chain or Tron) or across Ethereum layer-2 networks or sidechains (e.g., Polygon, OMG, Arbitrum). As the adoption of alternative blockchains and scalability networks increases, the liquidity of stablecoins finds its way into these alternative networks. Some of these today hold even billions of US dollars’ worth of stablecoin liquidity. Just as an example, Table 1 shows the fully diluted market cap (also means liquidity for stables) of some of the favorite stablecoins (and Ether) merely on each of the given major networks [3]–[26]. Note that some networks include both ETH and its wrapped version WETH, which are aggregated in the table, where ‘b’ stands for billions.

* WETH only. ETH not available.

One of the main reasons for stablecoins being transacted across different networks is related to the varying costs. Specifically, the fees and the speed of transferring ERC20 tokens, thus stablecoins, will differ substantially depending on the network chosen. These differences are due to numerous reasons, including the technology being used, security of the systems, level of decentralization, the congestion of the blockchain network (Mempool), the current price of the native blockchain token, the basic blockchain mechanics, and governance as well as the rewarding and incentive structures for miners.

Usually, transaction fees are also strictly related to the amount of Gas (or other means of) fees offered to reward the miners for processing the pending transactions. This is especially true for the Ethereum Network (and simile), where the fees set by the user determine the priority of the transaction in the Mempool queue. Therefore, generally speaking, the higher the fees, the faster the transaction.

3. Why use stablecoins for crypto-shopping

Between January and August 2021, Bitcoin was recorded as low as $29,374 and as high as $63,503. This means that if, as a consumer, you wanted to purchase a pair of shoes worth 100 USD on Zalando with Bitcoin, you would have paid 0.0034 Bitcoin on 01/01/2021 but 0.00157 on 04/13/2021. Furthermore, such price changes of Bitcoin can be very sudden, with single-digit appreciations or depreciations against USD, happening in hours if not minutes.

It is logical to assume that by shopping with stablecoins, users have different advantages, including but not limited to:

- It is easier to understand how much they are paying for a certain good or service in relation to its fiat value.

- There will not be sudden changes to the price.

- To the extent the stablecoin was no longer considered an active investment, it can be used without the regret of future gains.

4. Issues regarding shopping with stablecoins

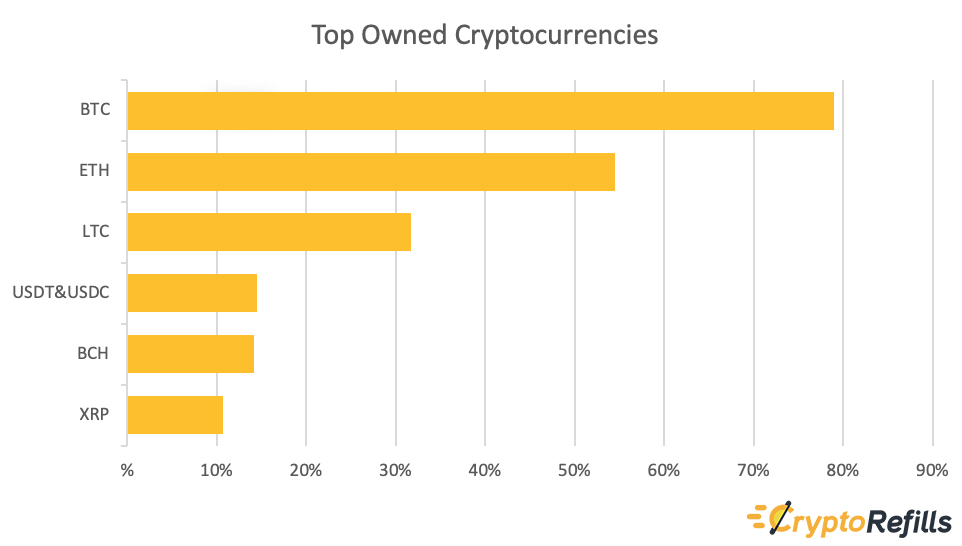

When used for shopping, stablecoins clearly provide some advantages when compared to other –more volatile – cryptocurrencies. This is also corroborated by some findings from our prime research on crypto-shopper behaviors. In fact, as shown in the chart below, the third-most important reason for not using cryptocurrency for purchasing goods and services is their exchange volatility. 41% of cryptos-hoppers agree with the following statement: “if crypto prices rise, I’ll lose money”. Moreover, 34% of crypto-shoppers agree with the following: “crypto is a means for investment, not shopping”.

It is interesting to understand that to what degree the advantages described above will influence the crypto-shoppers’ choice of favoring stablecoins instead of other volatile cryptos. And if and how many other factors are hindering the uptake of stablecoin shopping.

According to our consumer research [1], Bitcoin is still the most preferred cryptocurrency for shopping in 2021, followed by Ether (ETH) and Litecoin (LTC). Stable coins come only after.

The preference for Bitcoin, Litecoin and Ethereum, was also confirmed by our transactions data, where about 70% of payments appear to be done via these three currencies.

Interestingly, stablecoins, despite their huge aggregate liquidity, wide adoption in DeFi, and their intrinsic volatility mitigation features, only rank the 5th in terms of preference for shopping purposes (with less than 20% of users expressing a preference for using stablecoins to pay for goods and services in late 2020). We assume this is, to a great extent, due to the costs related to transacting such tokens over the Ethereum network. Because the wish – or the future intention – to be able to use them in shopping reaches as high as 50%, per to the report [1]. As we mentioned previously, alternative blockchains and scalability solutions are available and have, in fact, gained great popularity by the time, especially in DeFi and Dapps – including games.

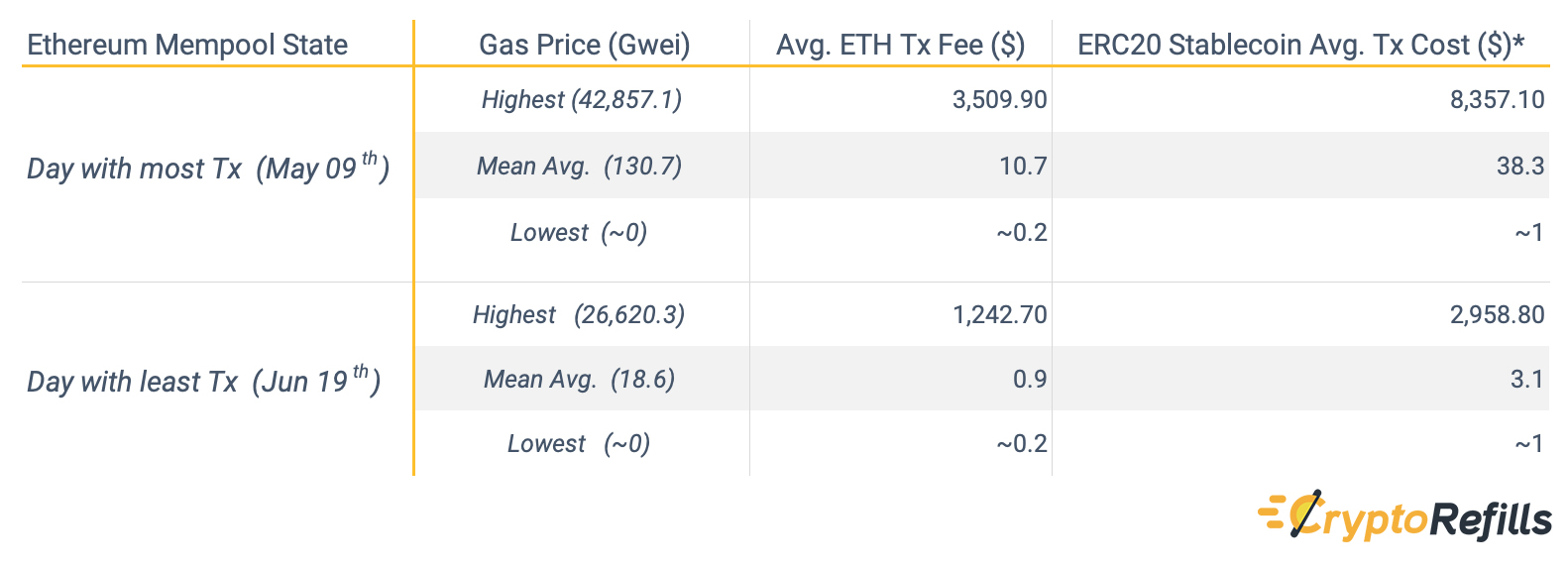

In the table below, we provide an overview of the minimum, maximum, and the median cost of transferring ERC20 stablecoin tokens (thus, the major stablecoins) during 2021/H1 within the top blockchains [27], [28].

*We used USDT as a reference for the cost. Other stable coin Tx costs may vary slightly from USDT, but the difference is negligible. Gas limits for USDT were considered 50000, 75000, and 100000 for highest, medium, and lowest gas prices in the mentioned order.

When it comes to shopping, transaction fees can be a huge issue, and this is because they are totally unrelated to the amount being transacted. In fact, the lower the amount being transacted, the more unreasonable it becomes to pay higher fees. While it may be reasonable to spend 30 USD worth of fees if using stablecoins to buy a 30,000 USD vehicle (0.1% cost), it makes no sense to pay such fees for 10 USD mobile credit top-up (300% cost).

Not only, as we said earlier, the fees paid, especially concerning the Ethereum network, will affect the priority of the transaction within the Mempool. So that users not paying with the highest fees may have to wait several minutes for the transaction to be completed and may also see the transaction rejected if the fees were too low. Therefore, the choice of the currency, blockchain fees will also greatly affect the general shopping experience in relation to the costs and time required to complete the transactions.

5. Layer-2 blockchains and scalability networks for stablecoin shopping

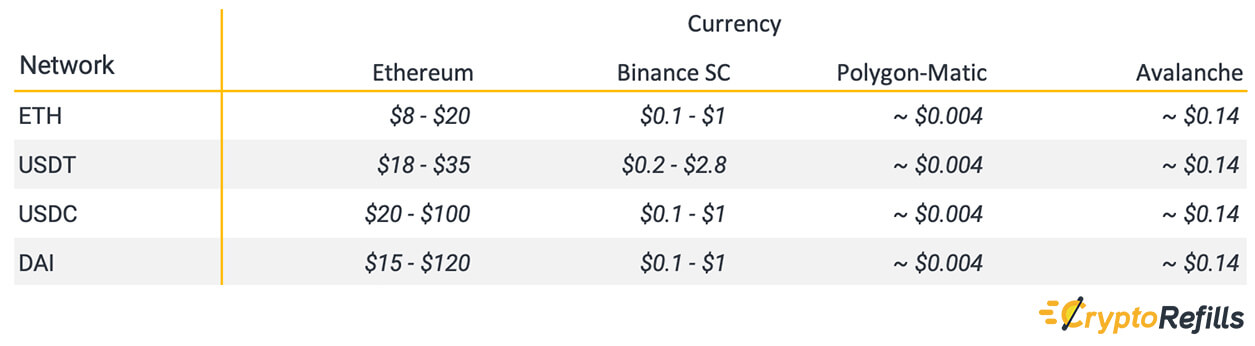

The possibility of transacting stablecoins over alternative blockchains and Ethereum Layer-2 networks solves two extremely important issues: transaction speed and associated costs. The table shows the expected value of how much one would pay for a simple transaction per currency per network as of Nov 11, 2021 [3]–[7], [9]–[18], [29].

* WETH only. ETH not available.

As we can see in the table above, where we compare different blockchain technologies that support stablecoin transactions, it is possible to greatly reduce the fees paid by shoppers by adopting alternative blockchains that support stablecoins. Furthermore, besides being cheaper, some of these solutions are also much faster as they can process many more transactions per second than the Ethereum Network.

6. Conclusions

As alternative blockchains have become widely popular for DeFi and Dapps, we believe that they will become increasingly promising for crypto-shopping as well and will especially drive the adoption of stablecoins for shopping. Currently, DeFi technology and Dapps, due to their complexity, target specific (i.e., niche) demographics and are still far from mass adoption, even in terms of the general crypto segment. Therefore, user experience, user-friendliness, and educating the users are still key to drive adoption. Even more obviously, the availability of stores (like CryptoRefills) that offer stablecoin payment options over Polygon, Avalanche, and Fantom is likely still the biggest driver to the rise of “stablecoin-shoppers”. This said, just as El Salvador’s approval of Bitcoin as a legal tender triggered the demand for Lightning Network, market and other external factors may suddenly increase both demand and offer of stablecoin payments. Unlike Bitcoin that sees Lightning Network as its only consumer scalability solution, in the case of stablecoins, fragmentation is still big among currencies and technologies. In this regard, it is likely that the networks that will see the highest growth are those that have the best combination of higher liquidity, lower transactions costs, and faster transaction rates.

Stay crypto-tuned!

Massimilliano Silenzi, CEO

Umut Can Çabuk

CryptoRefills.Labs

References

[1] U. C. Cabuk and M. Silenzi, Cryptocurrencies in Retail: Consumer Adoption Report 2021. CryptoRefills, 2021. doi: 10.6084/M9.FIGSHARE.14790384.

[2] “Tether price today, USDT to USD live, marketcap and chart | CoinMarketCap.” https://coinmarketcap.com/currencies/tether/ (accessed Nov. 17, 2021).

[3] “Ethereum (ETH) Blockchain Explorer.” https://etherscan.io/ (accessed Nov. 17, 2021).

[4] “$0.9956 | Tether USD (USDT) Token Tracker | Etherscan.” https://etherscan.io/token/0xdac17f958d2ee523a2206206994597c13d831ec7 (accessed Nov. 17, 2021).

[5] “$0.9982 | USD Coin (USDC) Token Tracker | Etherscan.” https://etherscan.io/token/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48 (accessed Nov. 17, 2021).

[6] “$0.9983 | Dai Stablecoin (DAI) Token Tracker | Etherscan.” https://etherscan.io/token/0x6b175474e89094c44da98b954eedeac495271d0f (accessed Nov. 17, 2021).

[7] “Binance-Peg Ethereum Token (ETH) Token Tracker | BscScan.” https://bscscan.com/token/0x2170ed0880ac9a755fd29b2688956bd959f933f8 (accessed Nov. 17, 2021).

[8] “Binance-Peg BSC-USD (BSC-USD) Token Tracker | BscScan.” https://bscscan.com/token/0x55d398326f99059ff775485246999027b3197955 (accessed Nov. 17, 2021).

[9] “Binance-Peg USD Coin (USDC) Token Tracker | BscScan.” https://bscscan.com/token/0x8ac76a51cc950d9822d68b83fe1ad97b32cd580d (accessed Nov. 17, 2021).

[10] “Binance-Peg Dai Token (DAI) Token Tracker | BscScan.” https://bscscan.com/token/0x1af3f329e8be154074d8769d1ffa4ee058b1dbc3 (accessed Nov. 17, 2021).

[11] “Wrapped Ether (WETH) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x7ceb23fd6bc0add59e62ac25578270cff1b9f619 (accessed Nov. 17, 2021).

[12] “(PoS) Tether USD (USDT) Token Tracker | PolygonScan.” https://polygonscan.com/token/0xc2132d05d31c914a87c6611c10748aeb04b58e8f (accessed Nov. 17, 2021).

[13] “USD Coin (PoS) (USDC) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x2791bca1f2de4661ed88a30c99a7a9449aa84174 (accessed Nov. 17, 2021).

[14] “(PoS) Dai Stablecoin (DAI) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x8f3cf7ad23cd3cadbd9735aff958023239c6a063 (accessed Nov. 17, 2021).

[15] “C-Chain: Token: Wrapped Ether \ AVASCAN.” https://avascan.info/blockchain/c/token/0x49D5c2BdFfac6CE2BFdB6640F4F80f226bc10bAB (accessed Nov. 17, 2021).

[16] “C-Chain: Token: Tether USD \ AVASCAN.” https://avascan.info/blockchain/c/token/0xc7198437980c041c805A1EDcbA50c1Ce5db95118 (accessed Nov. 17, 2021).

[17] “C-Chain: Token: USD Coin \ AVASCAN.” https://avascan.info/blockchain/c/token/0xA7D7079b0FEaD91F3e65f86E8915Cb59c1a4C664 (accessed Nov. 17, 2021).

[18] “C-Chain: Token: Dai Stablecoin \ AVASCAN.” https://avascan.info/blockchain/c/token/0xd586E7F844cEa2F87f50152665BCbc2C279D8d70 (accessed Nov. 17, 2021).

[19] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/THb4CqiFdwNHsWsQCs4JhzwjMWys4aqCbF (accessed Nov. 17, 2021).

[20] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t (accessed Nov. 17, 2021).

[21] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TEkxiTehnzSmSe2XqrBj4w32RUN966rdz8 (accessed Nov. 17, 2021).

[22] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TY9r6CxEMevRENjJv3uheGCiz5j3TFf9rv (accessed Nov. 17, 2021).

[23] “Explorer | Solana.” https://explorer.solana.com/address/2FPyTwcZLUg1MDrwsyoP4D6s1tM7hAkHYRjkNb5w6Pxk (accessed Nov. 17, 2021).

[24] “Explorer | Solana.” https://explorer.solana.com/address/BQcdHdAQW1hczDbBi9hiegXAR7A98Q9jx3X3iBBBDiq4 (accessed Nov. 17, 2021).

[25] “Explorer | Solana.” https://explorer.solana.com/address/EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v (accessed Nov. 17, 2021).

[26] “Explorer | Solana.” https://explorer.solana.com/address/FYpdBuyAHSbdaAyD1sKkxyLWbAP8uUW9h6uvdhK74ij1 (accessed Nov. 17, 2021).

[27] “Ethereum Daily Transactions Chart | Etherscan.” https://etherscan.io/chart/tx (accessed Nov. 17, 2021).

[28] “Ethereum Average Gas Price Chart | Etherscan.” https://etherscan.io/chart/gasprice (accessed Nov. 17, 2021).

[29] “Binance-Peg BUSD Token (BUSD) Token Tracker | BscScan.” https://bscscan.com/token/0xe9e7cea3dedca5984780bafc599bd69add087d56 (accessed Nov. 17, 2021).

[2] “Tether price today, USDT to USD live, marketcap and chart | CoinMarketCap.” https://coinmarketcap.com/currencies/tether/ (accessed Nov. 17, 2021).

[3] “Ethereum (ETH) Blockchain Explorer.” https://etherscan.io/ (accessed Nov. 17, 2021).

[4] “$0.9956 | Tether USD (USDT) Token Tracker | Etherscan.” https://etherscan.io/token/0xdac17f958d2ee523a2206206994597c13d831ec7 (accessed Nov. 17, 2021).

[5] “$0.9982 | USD Coin (USDC) Token Tracker | Etherscan.” https://etherscan.io/token/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48 (accessed Nov. 17, 2021).

[6] “$0.9983 | Dai Stablecoin (DAI) Token Tracker | Etherscan.” https://etherscan.io/token/0x6b175474e89094c44da98b954eedeac495271d0f (accessed Nov. 17, 2021).

[7] “Binance-Peg Ethereum Token (ETH) Token Tracker | BscScan.” https://bscscan.com/token/0x2170ed0880ac9a755fd29b2688956bd959f933f8 (accessed Nov. 17, 2021).

[8] “Binance-Peg BSC-USD (BSC-USD) Token Tracker | BscScan.” https://bscscan.com/token/0x55d398326f99059ff775485246999027b3197955 (accessed Nov. 17, 2021).

[9] “Binance-Peg USD Coin (USDC) Token Tracker | BscScan.” https://bscscan.com/token/0x8ac76a51cc950d9822d68b83fe1ad97b32cd580d (accessed Nov. 17, 2021).

[10] “Binance-Peg Dai Token (DAI) Token Tracker | BscScan.” https://bscscan.com/token/0x1af3f329e8be154074d8769d1ffa4ee058b1dbc3 (accessed Nov. 17, 2021).

[11] “Wrapped Ether (WETH) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x7ceb23fd6bc0add59e62ac25578270cff1b9f619 (accessed Nov. 17, 2021).

[12] “(PoS) Tether USD (USDT) Token Tracker | PolygonScan.” https://polygonscan.com/token/0xc2132d05d31c914a87c6611c10748aeb04b58e8f (accessed Nov. 17, 2021).

[13] “USD Coin (PoS) (USDC) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x2791bca1f2de4661ed88a30c99a7a9449aa84174 (accessed Nov. 17, 2021).

[14] “(PoS) Dai Stablecoin (DAI) Token Tracker | PolygonScan.” https://polygonscan.com/token/0x8f3cf7ad23cd3cadbd9735aff958023239c6a063 (accessed Nov. 17, 2021).

[15] “C-Chain: Token: Wrapped Ether \ AVASCAN.” https://avascan.info/blockchain/c/token/0x49D5c2BdFfac6CE2BFdB6640F4F80f226bc10bAB (accessed Nov. 17, 2021).

[16] “C-Chain: Token: Tether USD \ AVASCAN.” https://avascan.info/blockchain/c/token/0xc7198437980c041c805A1EDcbA50c1Ce5db95118 (accessed Nov. 17, 2021).

[17] “C-Chain: Token: USD Coin \ AVASCAN.” https://avascan.info/blockchain/c/token/0xA7D7079b0FEaD91F3e65f86E8915Cb59c1a4C664 (accessed Nov. 17, 2021).

[18] “C-Chain: Token: Dai Stablecoin \ AVASCAN.” https://avascan.info/blockchain/c/token/0xd586E7F844cEa2F87f50152665BCbc2C279D8d70 (accessed Nov. 17, 2021).

[19] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/THb4CqiFdwNHsWsQCs4JhzwjMWys4aqCbF (accessed Nov. 17, 2021).

[20] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t (accessed Nov. 17, 2021).

[21] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TEkxiTehnzSmSe2XqrBj4w32RUN966rdz8 (accessed Nov. 17, 2021).

[22] “TRONSCAN | TRON BlockChain Explorer | 波场区块链浏览器.” https://tronscan.org/#/token20/TY9r6CxEMevRENjJv3uheGCiz5j3TFf9rv (accessed Nov. 17, 2021).

[23] “Explorer | Solana.” https://explorer.solana.com/address/2FPyTwcZLUg1MDrwsyoP4D6s1tM7hAkHYRjkNb5w6Pxk (accessed Nov. 17, 2021).

[24] “Explorer | Solana.” https://explorer.solana.com/address/BQcdHdAQW1hczDbBi9hiegXAR7A98Q9jx3X3iBBBDiq4 (accessed Nov. 17, 2021).

[25] “Explorer | Solana.” https://explorer.solana.com/address/EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v (accessed Nov. 17, 2021).

[26] “Explorer | Solana.” https://explorer.solana.com/address/FYpdBuyAHSbdaAyD1sKkxyLWbAP8uUW9h6uvdhK74ij1 (accessed Nov. 17, 2021).

[27] “Ethereum Daily Transactions Chart | Etherscan.” https://etherscan.io/chart/tx (accessed Nov. 17, 2021).

[28] “Ethereum Average Gas Price Chart | Etherscan.” https://etherscan.io/chart/gasprice (accessed Nov. 17, 2021).

[29] “Binance-Peg BUSD Token (BUSD) Token Tracker | BscScan.” https://bscscan.com/token/0xe9e7cea3dedca5984780bafc599bd69add087d56 (accessed Nov. 17, 2021).