Introducing the 2024 stablecoin in crypto-shopping report

By Massimiliano Silenzi

The importance of stablecoins and alternatives to Ethereum mainnet in driving consumer purchases with cryptocurrencies

Introduction to the report

The conceptual foundation of cryptocurrencies was laid out in 2008 by an individual or group under the pseudonym “Satoshi Nakamoto”. In the groundbreaking whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” Bitcoin was introduced as a decentralized digital currency designed to enable direct transactions between parties without needing a trusted third party, such as a bank or a financial institution. This innovative approach promised a revolution in the financial world by offering a new way of conducting transactions, emphasizing peer-to-peer transactions, anonymity, low transaction fees, and removing intermediaries[1].

However, the journey from theory to practice revealed several challenges and evolving perceptions of Bitcoin. Initially envisioned as a medium of exchange, Bitcoin’s volatility, scalability issues, and the slow processing time of transactions have led to its increasing perception as a digital commodity or asset class akin to gold. This view of Bitcoin as a digital “gold” has been reinforced by its deflationary nature, capped supply, and independence from traditional financial systems, making it an attractive option for investors looking for an innovative hedge against inflation. This shift is largely attributed to its store of value characteristics, which overshadow its current practicality as a medium of exchange in everyday transactions[2].

Volatility, in particular, has been a critical barrier to the adoption of Bitcoin (or any cryptocurrency not pegged to a major fiat currency) as a unit of account and currency for daily transactions. The rapid and significant price fluctuations discourage both retailers and consumers from using Bitcoin and any volatile crypto as a payment method, fearing potential losses[3]. Interestingly, this resonates with a finding in the study we published in December, where we registered a slightly negative correlation between expertise in Bitcoin and the propensity to shop with cryptocurrency[4].

A key innovation in the cryptocurrency industry has been the introduction of stablecoins, a type of cryptocurrency designed to maintain a stable value as opposed to the significant price volatility seen in other cryptocurrencies like Bitcoin and Ethereum. This stability is typically achieved by pegging the stablecoin to a reserve asset, such as the US dollar. However, besides volatility, also scalability is a very important topic to be considered when analyzing the use of cryptocurrencies as a payment method for shopping. With respect to Bitcoin, the scalability issue, highlighted by the limited number of transactions that can be processed per second, has led to increased transaction fees and delays, further deterring its use for small or medium-sized transactions[5]. To a lesser extent, scalability, processing fees and time, have also been an issue for Eth and stablecoin transactions made directly over the Ethereum network. Our yearly market reports have shown that transaction fees and time are perceived as major issues by Crypto-shoppers. In 2023, fees and speed rank respectively first (35.5%) and sixth (16%) in terms of issues faced by consumers[6]. There are different solutions to scale Bitcoin payments (via the Lightning Network) and stablecoin payments using Ethereum Layer 2 networks and sidechains (like Arbitrum or Optimism), as well as via alternative Layer 1 networks such as Solana, Tron or Avalanche, and as we will see in this study these solutions play a critical role in the adoption of stablecoin payments.

Maybe in the distant future, all goods, services, and assets will be priced in Bitcoin, making it also the unit of account and, via Lightning, the main medium of exchange, maybe even a global legal tender. However, besides not being authorized to give any financial advice, this type of prediction is way beyond our skills and competence. Instead, in this study, we focus on the present and near future; we analyze the practical needs of crypto adoption for buying goods and services. We feel confident to say that today there is a very strong demand by Crypto-shoppers for stablecoin payments, and in this special report, we analyze such demand in relation to the intention to purchase, shopping frequency, and in terms of currency and technology preferences.

Key findings of this report

Almost 80% of Crypto-shoppers prefer to pay for goods and services with stablecoins over Bitcoin, Eth and other cryptocurrencies

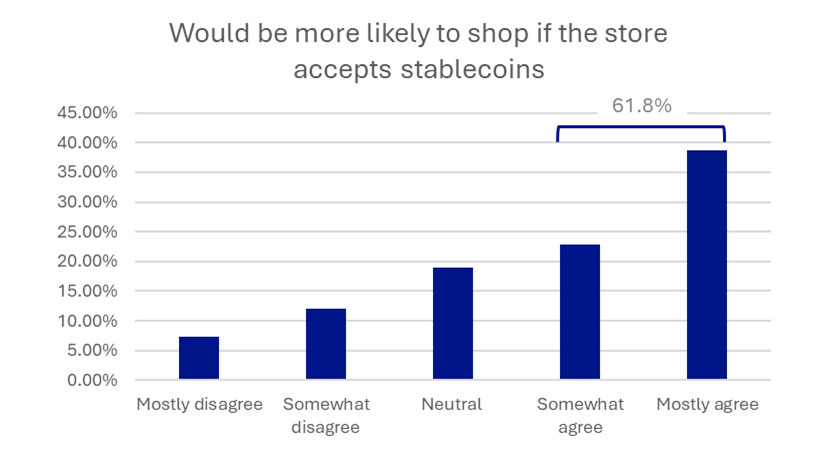

62% of consumers shopping with cryptocurrencies would be more likely to shop if the store accepts stablecoins

Shoppers that prefer stablecoins shop slightly more often (small but statistically significant correlation)

38% of Crypto-shoppers believe that Bitcoin and other cryptos like ETH or LTC should not be spent as they will rise in value in the future

Tether (USDT) and USD Coin (USDC) dominate in terms of preferred stablecoins with no other stablecoin coming close in terms of preference.

64% Crypto-shoppers have used an L2, sidechain or alternative L1 network at least once.

86% of stablecoin payments are made on Eth L2s, sidechains or alternative L1s. However, there is great fragmentation of shopping transactions across these different networks.

References

1. Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

2. Glaser, F., Zimmermann, K., Haferkorn, M., Weber, M. C., & Siering, M. (2014). Bitcoin – Asset or Currency? Revealing Users’ Hidden Intentions.

3. Yermack, D. (2015). Is Bitcoin a Real Currency? An Economic Appraisal.

4. Silenzi, M., Çabuk, U., C., (Dec 2023). Deciphering the Crypto-shopper: Knowledge and Preferences of Consumers Using Cryptocurrencies for Purchases. Cryptorefills Labs

5. Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, Technology, and Governance.

6. Silenzi, M., Çabuk, U., C., (Nov 2023). Cryptocurrencies in Commerce: Consumer Adoption Report 2023. Cryptorefills Labs.