Deciphering the Crypto-Shopper: Introduction to our research paper

By Massimiliano Silenzi

In the ever-evolving landscape of digital finance, cryptocurrencies have emerged as a transformative force, reshaping not just investment strategies but also consumer spending habits. The groundbreaking study “Deciphering the Crypto-shopper: Knowledge and Preferences of Consumers Using Cryptocurrencies for Purchases” study authored by Massimiliano Silenzi, Ph.D. and Umut Can Çabuk, Ph.D. provides a comprehensive analysis of this emerging phenomenon. This research, involving a detailed survey of 516 participants, delves into the knowledge, expertise, and purchasing patterns of individuals using cryptocurrencies for shopping, offering unique insights into the behavior of crypto-shoppers.

This article emphasizes the business implications of these findings. It distills complex data into simpler terms and provides pragmatic insights into how businesses can adapt and thrive in this new era of digital finance. Whether you’re a business owner, a marketer, or simply curious about the intersection of cryptocurrencies and consumer behavior, this article aims to offer valuable perspectives to understand the crypto-shopper landscape.

The full research paper is available as a preprint at https://arxiv.org/abs/2310.02911

Study Overview

The study’s primary objective was to uncover the levels of knowledge and expertise among crypto-shoppers and how these factors influence their purchasing behaviors. The research methodology included a meticulously designed survey, followed by a sophisticated analysis comprising descriptive statistics, correlation and regression analyses, and K-means cluster analysis.

Survey Design and Data Collection

The survey, part of the 2023 Cryptorefills Labs report, was conducted from June 1st to September 9th, 2023. It targeted Cryptorefills customers who had completed at least one purchase, thereby confirming their status as authentic crypto-shoppers. The survey comprised 145 multiple-choice questions, focusing on respondents’ behaviors, demographics, perceptions, experiences, and cryptocurrency familiarity. Notably, 17 questions specifically addressed knowledge and expertise, utilizing a 5-point Likert scale.

Key Findings

Varied Knowledge Levels Among Participants

One of the study’s striking revelations was the broad spectrum of knowledge levels among respondents. While a notable proportion exhibited a fundamental understanding of cryptocurrencies, there was considerable variation in expertise levels, especially concerning more specialized domains like the Lightning Network, Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs).

High Purchase Frequency Despite Limited Knowledge

Contrary to conventional expectations, about 30% of respondents demonstrated high purchase frequency even with limited cryptocurrency knowledge. This suggests that factors other than just domain knowledge might be influencing purchasing behavior.

Descriptive Statistics

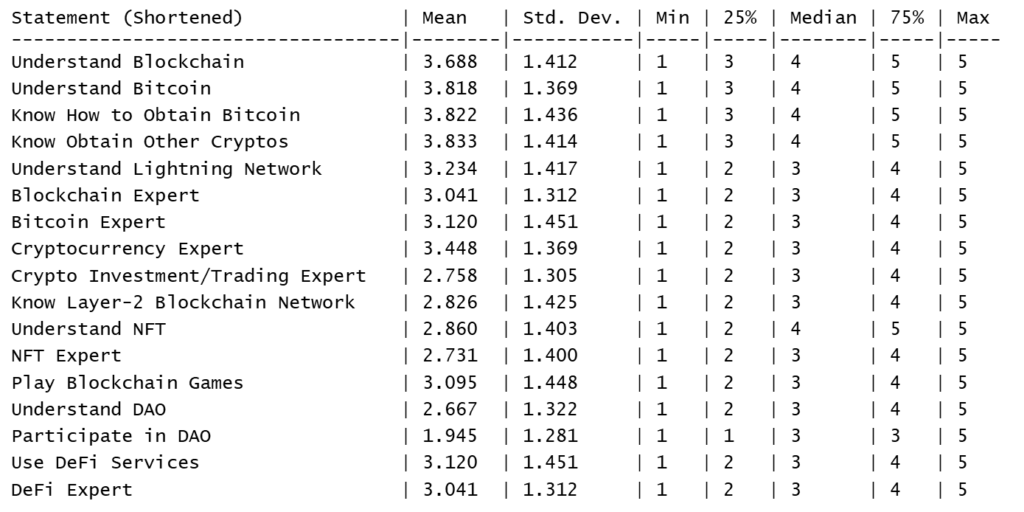

The descriptive statistics provided a detailed overview of the respondents’ knowledge and expertise levels. For instance, the average rating for understanding blockchain and bitcoin was 3.69 and 3.82, respectively. However, self-perceived expertise in these areas hovered around a score of 3, indicating a gap between general knowledge and specialized expertise.

Visual Analysis and Figures

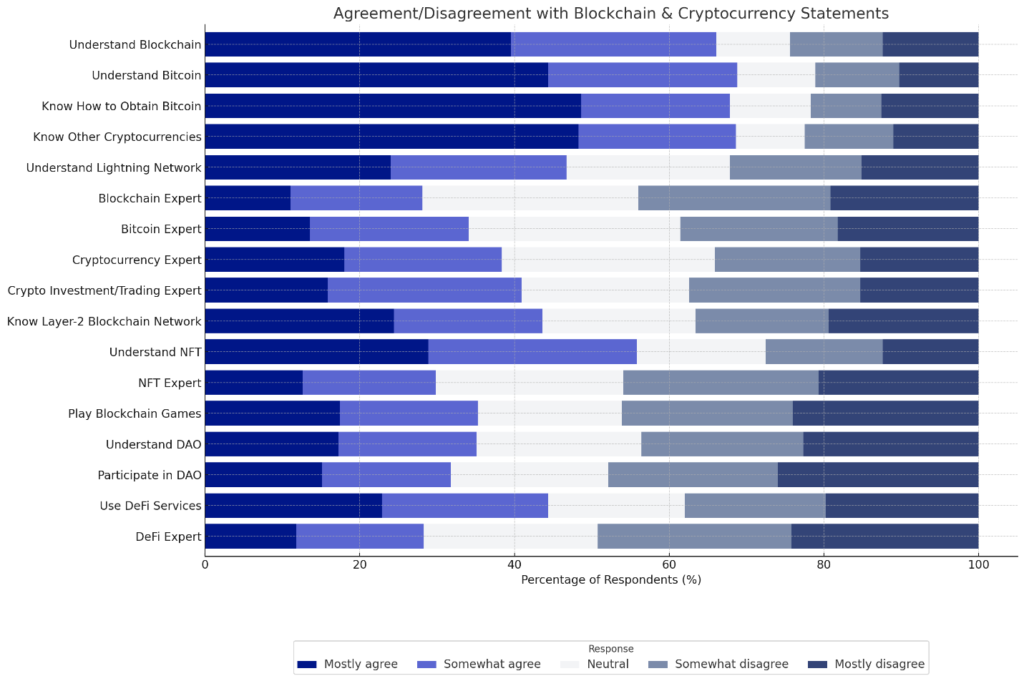

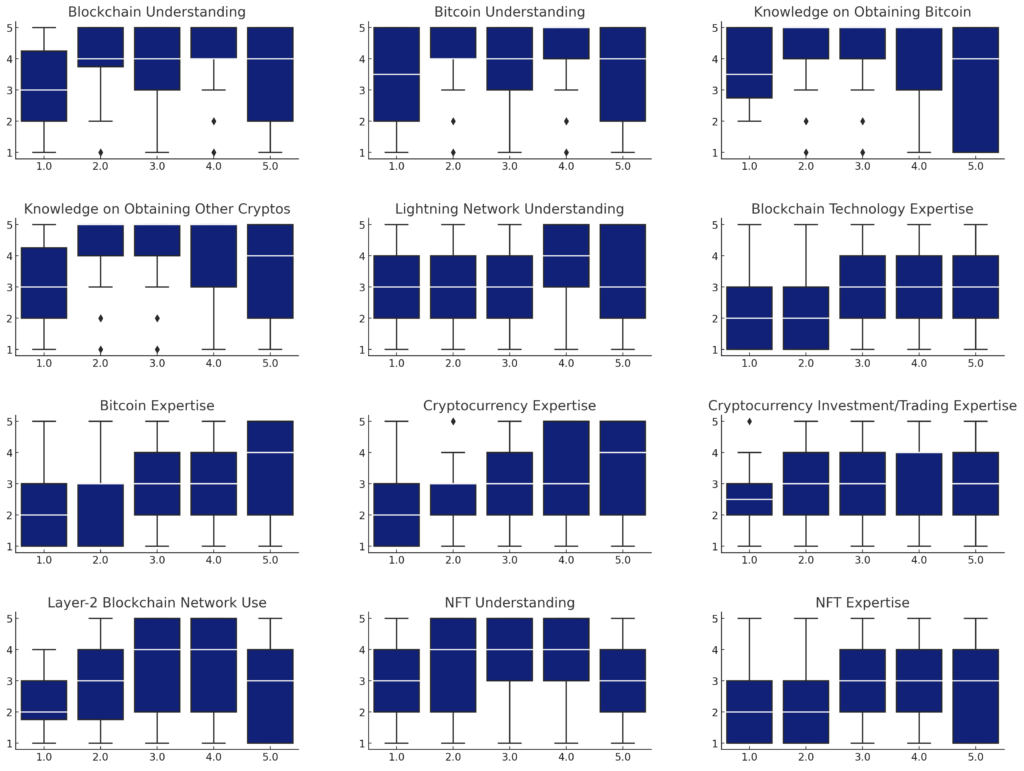

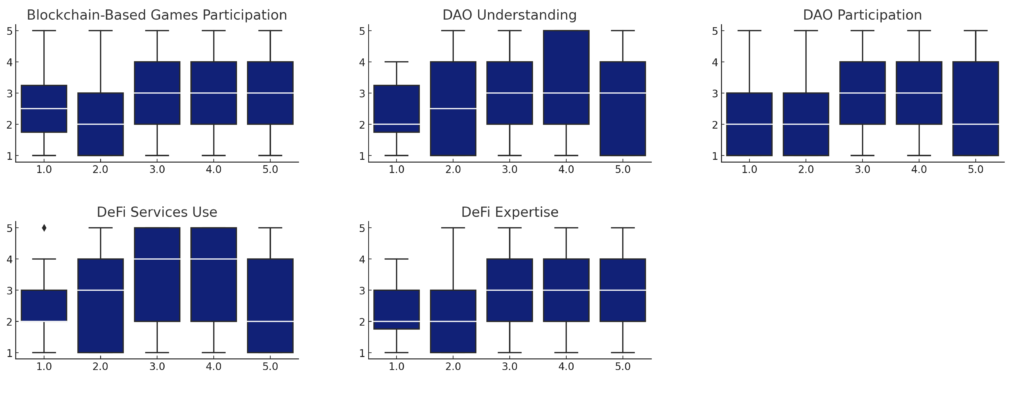

The study utilized visual tools such as bar charts, scatter plots, and radar plots to articulate findings. For example, Figure 1 in the study illustrates the stacked distribution of responses on blockchain and cryptocurrency expertise, offering a visual representation of the respondents’ self-assessed knowledge levels.

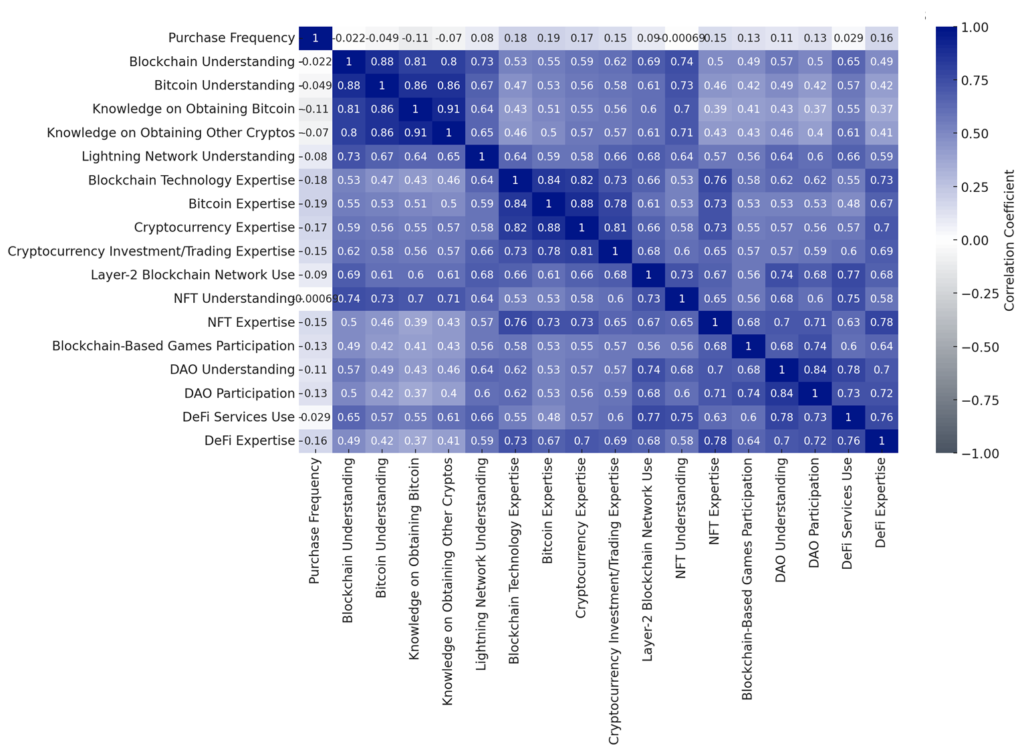

Correlation and Regression Analysis

The correlation analysis revealed negative correlations between purchase frequency and all knowledge variables, with “Knowledge on Obtaining Bitcoin” showing the strongest negative correlation at -0.11. This implies that increased knowledge or expertise in specific areas might correlate with a decrement in purchase frequency. The regression model, detailed in Table 3, explained approximately 11.63% of the variance in purchase frequency, suggesting that other factors play a significant role in determining purchasing behavior.

Cluster Analysis

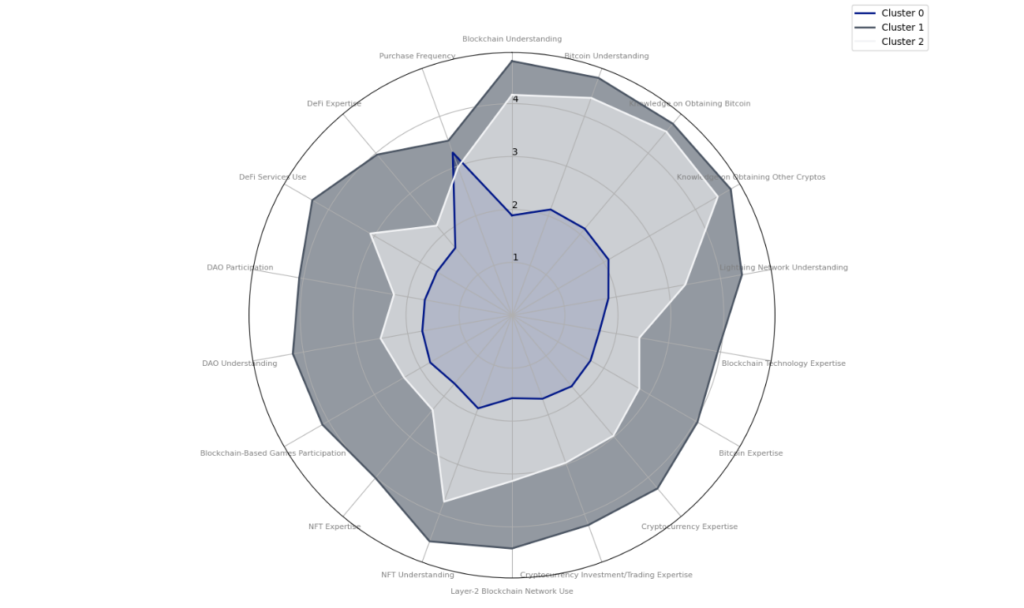

Using the K-means clustering technique, the study segmented the respondents into three distinct groups:

- Cluster 0 – The Low Knowledge Group (28.09% of the population): Displayed minimal knowledge, with foundational constructs like blockchain and bitcoin averaging between 1.8 and 2.1. Despite their limited knowledge, their purchasing frequency was substantial, approximating 3.27.

Cluster 1 – The Expert Group (35.06% of the population): Exhibited profound knowledge and expertise across general and specialized topics. Their ratings for foundational pillars like blockchain and bitcoin were approximately 4.8, and they engaged actively in blockchain and crypto applications. Their purchasing frequency was marginally higher than the Low Knowledge Group, at around 3.51.

Cluster 2 – The Moderate Knowledge Group (36.85% of the population): Possessed a decent grasp of cryptocurrency basics, with metrics around 4.2 for both blockchain and bitcoin. Their understanding waned slightly for more advanced topics, and their purchasing frequency was moderately rated.

About Cryptorefills

Cryptorefills is on a mission to enable people all over the world to spend Bitcoin and other cryptocurrencies for their everyday needs. With Cryptorefills, people from over 150 countries and territories can top up their mobile credit and buy gift cards with Bitcoin and other crypto from the world’s largest digital and retail brands. As one of the earliest adopters of the Bitcoin Lightning Network, and as the first company in the world to launch Ethereum layer-2 payments (via Polygon Matic and Arbitrum) and fast finality blockchains (via Avalanche and Fantom) for E-commerce payments, Cryptorefills is leading the innovation in applied decentralized payments and developing new technologies for the gift card industry.

The Company is also very active in researching and educating on consumer spending of cryptocurrency in retail through its Labs initiative and publishes an annual report on the global use of crypto for purchasing goods and services. Cryptorefills is a fast-growing fintech, headquartered in Amsterdam, and a proud member of the Holland Fintech Association and Blockchain Netherlands Foundation.

Website | Twitter | LinkedIn | For information and press enquiries: media@cryptorefills.com

For information concerning Cryptorefills research and annual report on consumer spending of cryptocurrency in retail: https://labs.cryptorefills.com/