Cryptorefills unravels cryptoshopper knowledge levels

Abstract

The rapidly evolving cryptocurrency sector offers both challenges and opportunities for businesses and consumers alike. This study investigates the knowledge, expertise, and purchasing behaviors of crypto-shoppers, aiming to provide a comprehensive understanding of this unique consumer group. Drawing upon data from 516 respondents, our findings highlight a spectrum of knowledge levels, from novices to experts, with a notable segment demonstrating high purchasing frequency despite limited expertise. Regression analyses reveal that while knowledge plays a role in influencing purchase behaviors, its explanatory power is limited. Moreover, a K-Means cluster analysis uncovers three distinct crypto-shopper profiles, each with unique knowledge and expertise levels. These insights challenge conventional beliefs about the relationship between domain knowledge and adoption, suggesting that the allure of cryptocurrencies goes beyond technical understanding. The findings provide valuable insights for businesses looking to cater to the diverse needs of the crypto-shopper segment, emphasizing the importance of tailored strategies and user experiences. This study also sets the stage for future research to explore the broader implications of crypto adoption and its intersection with consumer behavior.

Deciphering the crypto-shopper: exploring knowledge, expertise, and purchase behavior

In recent years, the digital world has witnessed the meteoric rise of cryptocurrencies, with Bitcoin leading the charge as a revolutionary decentralized currency. Inspired by Satoshi Nakamoto’s vision of a peer-to-peer electronic cash system, the underlying ethos of Bitcoin and subsequent cryptocurrencies has always been to facilitate everyday transactions. Yet, while many recognize the speculative value of these digital assets, understanding their broader adoption and use in daily purchases remains a developing area of study.

This paper delves into the intricacies of the ‘crypto-shopper’, examining the depth of their domain knowledge and how it influences their purchasing behaviors. By analyzing the nuances of knowledge, expertise, and transactional behavior, we aim to offer insights into the evolving landscape of cryptocurrency adoption in commerce.

Literature review

Cryptocurrencies, spearheaded by Bitcoin, have gained significant attention in recent years. Satoshi Nakamoto’s (2008) original vision, as articulated in his seminal white paper, envisioned Bitcoin as a peer-to-peer electronic cash system, suggesting its potential use for everyday transactions. This literature review delves into the adoption dynamics of cryptocurrencies, emphasizing the role of knowledge in the uptake of novel technologies and specifically exploring the knowledge base of individuals using cryptocurrencies for shopping.

Adoption of bitcoin and cryptocurrencies

As of the year 2023, approximately 420 million individuals possess cryptocurrencies (Triple-A, 2023). While regarded by many as speculative assets, there is an emerging trend of employing Bitcoin and other cryptocurrencies for day-to-day transactions (Zhang et al., 2023). The 2022 CryptoRefills Labs Report (Çabuk & Silenzi, 2022) revealed that the most significant challenge for consumers utilizing cryptocurrencies for purchasing goods and services was the scarcity of stores accepting such digital assets; 48.2% of surveyed participants expressed this concern. On the merchant front, a report from Deloitte in 2022 indicated that 75% of CEOs planned to incorporate cryptocurrency as an accepted form of payment within the subsequent two years. However, it’s important to note that the data for this report was gathered between December 3 and 16, 2021, during a period of elevated cryptocurrency market activity and prior to the downturn in overall volume and market capitalization (Coinmarketcap, 2023).

According to data from coinmap.org (August 2023), there are 32,139 businesses globally that currently accept cryptocurrency. To provide context, Fundera reported in October 2022 that coinmap.org listed 15,174 businesses accepting cryptocurrency. This constitutes a very large increase of 111.8% in a mere ten-month span.

Knowledge and adoption of technologies

The adoption of new technology has been a subject of extensive research within the domains of innovation and technology adoption. Everett Rogers’ seminal work, “Diffusion of Innovations” (1962), has been foundational in shaping our understanding of technology adoption processes. Rogers emphasizes the role of knowledge as a critical factor in the diffusion of innovations. He outlines the sequential stages that individuals navigate when adopting new technologies, underscoring the significance of knowledge acquisition, communication channels, and social systems in this process.

Fred Davis’ “Technology Acceptance Model” (1989) introduces a framework that assesses the determinants of technology adoption. While the model is not solely focused on knowledge, it highlights the importance of perceived usefulness and perceived ease of use, both of which are linked to individuals’ understanding and awareness of a technology. This recognition reinforces the role of knowledge in influencing adoption decisions.

Lundvall’s exploration of “The Role of Knowledge in the Innovation Process” (1992) delves into the intricate relationship between knowledge and innovation. This work underscores the different forms of knowledge—tacit and explicit—and their significance at various stages of the innovation process, including technology adoption. The study accentuates the role of learning, knowledge sharing, and absorptive capacity in facilitating the adoption of new technologies.

Neil Pollock and Robin Williams’ study on “Digital Innovation and the Division of Labour” (2010) shifts the focus to digital innovations and the distribution of knowledge within organizations. This work illustrates how different actors contribute their knowledge and expertise, collectively shaping the adoption and implementation of new technologies. The authors shed light on the complex interplay between knowledge, labor division, and technology adoption.

A comprehensive review by Wisdom et al. (2013) titled “Innovation Adoption: A Review of Theories and Constructs” (2009) delves into diverse theoretical perspectives on innovation adoption. While encompassing a wide range of viewpoints, this review underscores the common thread of knowledge as a crucial element in decision-making processes related to technology adoption. The synthesis of various theories offers a comprehensive perspective on the multifaceted role of knowledge.

Knowledge is important in driving the adoption of new technologies like blockchain for payments. The acquisition and dissemination of knowledge influence individuals’ decisions to embrace and integrate innovations. The interplay of education, understanding, expertise, and organizational dynamics underscores the critical role of knowledge in optimizing the use and benefits of new technological advancements.

Crypto-shoppers Domain Specific Knowledge and Expertise

There’s limited literature on the knowledge and expertise of cryptocurrency users, especially those who use crypto for shopping. Alqaryouti et al. (2020) conducted a study based on interviews with three cryptocurrency users, revealing that the majority had a robust understanding of cryptocurrency, encompassing its technical facets such as mining and market cap. These users primarily viewed cryptocurrency as an investment tool and a currency, praising its benefits like decentralization, security, and cost-efficiency. Yet, they also highlighted its limited global acceptance as a drawback. Despite the study’s constrained sample size, it primarily addressed the broader cryptocurrency user base rather than narrowing down to the specific segment that employs cryptocurrency for shopping. Offering a more targeted perspective, the CryptoRefills Labs report by Cabuk & Silenzi (2021) delved into the distinct knowledge and expertise landscape of cryptoshoppers, delineating five knowledge parameters and four expertise dimensions specific to this group. The report highlighted that most crypto shoppers are familiar with basic blockchain and cryptocurrency concepts, with a notable majority recognizing Bitcoin and its operations, and with deeper technical knowledge, like the Lightning Network, remaining confined to a smaller expert subset. The report highlighted a direct relationship between crypto-consumers’ expertise in cryptocurrency trading and their shopping frequencies, with three-fourths of experts making crypto-purchases weekly.

The 2022 study by CryptoRefills Labs introduced six additional variables to assess the knowledge and expertise of crypto shoppers, encompassing areas like NFT expertise and a general understanding of DAOs. Data from the report suggests that 2022, crypto consumers’ understanding of blockchain and cryptocurrencies remains an important aspect in relation to their shopping habits. A substantial segment continues to grasp basic blockchain concepts and cryptocurrencies, with roughly 70% acknowledging Bitcoin, its procurement techniques, and its continued market supremacy. There’s a marked linkage between a shopper’s cryptocurrency expertise and their purchasing frequency, with the majority of experts opting for crypto-based transactions at least once a week, underscoring the enduring relevance of well-acquainted crypto consumers. The 2022 version of the Report also introduced for the first time a cluster analysis of Crypto-shoppers.

The 2022 study by CryptoRefills for the first time offered a cluster analysis, employing the K-prototypes clustering technique across 29 distinct variables from the survey data to categorize the diverse crypto user base. Of the 29 variables, five were specifically tied to knowledge and expertise, while the other critical variables that encompassed demographics, geographic location, and, notably, constructs related to the Technology Acceptance Model 2 (TAM2) such as Perceived Ease of Use, Perceived Usefulness, and Social Influence. The identification of seven distinct clusters in the 2022 report suggests a growing complexity in the crypto user landscape. No longer can crypto shoppers be broadly categorized into simple binaries such as financially excluded users from emerging markets vs tech savvy users from advanced market. Instead, this cluster analysis implies a spectrum of user types, each with unique combinations of knowledge, demographic attributes, geographical influences, and perceptions influenced by the TAM2 constructs.

Research Questions

While the CryptoRefills reports of 2021 and 2022 provided initial insights into the correlation between domain knowledge and crypto purchase frequency, several gaps remain. Firstly, the reports offered a surface-level description, lacking a comprehensive analysis of the varying levels of knowledge and expertise among crypto consumers. Secondly, the in-depth relationship between knowledge/expertise and purchase frequency wasn’t thoroughly explored. While the 2022 report provided a comprehensive crypto-shopper segmentation through its cluster analysis, capturing a wide spectrum of user types with diverse knowledge bases, demographics, geographical influences, and perceptions, it did so using only five distinct variables related to knowledge and expertise. Given the vastness of the crypto sector, which spans across various realms from technology to finance, from currency paradigms to infrastructural frameworks, and from governance models to the burgeoning fields of NFTs and blockchain gaming (all encapsulated within the 17 variables of knowledge and expertise), there may be merit in a segmentation that focuses exclusively on all these distinct aspects of knowledge and expertise as well as adding purchase frequency behavior as an extra dimension of the analysis.

Building upon the new dataset utilized for the upcoming CryptoRefills Labs 2023 report, which delineates the levels of knowledge in a manner consistent with its predecessors and introduces longitudinal studies tracing the evolution of knowledge, expertise, and purchase frequency over three years, this study aims to go narrower and deeper, targeting the identified gaps in the literature by posing the following three research questions:

RQ1. What are the detailed descriptions of the levels of knowledge and expertise among crypto-shoppers, and how do these levels manifest in their utilization of cryptocurrencies for making purchases?

RQ2. How do different levels of knowledge and expertise among crypto shoppers correlate with their purchase frequencies, are there nuanced patterns or trends within these correlations, and Is there a more in-depth relationship between domain knowledge/expertise and purchase frequency that goes beyond the preliminary findings from the CryptoRefills Labs reports?

RQ3. Can specific groups or clusters of crypto-shoppers be identified based on their knowledge, expertise, and shopping frequency, and if so, how do these groups differ in their crypto-shopping patterns and preferences?

Methodology

Survey

This study utilizes data from the 2023 CryptoRefills Labs report, sourced from a survey of CryptoRefills customers who have made at least one purchase, thus affirming their status as genuine crypto shoppers and therefore in line with the scope of our research questions. The 2023 survey was made available to Cryptorefills customers starting from June 1st 2023 to September 9th 2023.

Incentives

CryptoRefills, the platform hosting the survey, offered participants an incentive through its loyalty program. Respondents were rewarded with 300 points, which roughly equates to just under $3 USD. It’s worth noting that this amount of points, while appealing, wasn’t adequate on its own to claim a significant reward on CryptoRefills. This approach was carefully designed to make the incentive attractive without exerting undue influence, ensuring that the authenticity of responses remained intact.

Alongside the incentive, CryptoRefills employed a diverse promotional strategy, utilizing email invitations, social media advocacy through Twitter, and prominent integration on the website to raise survey awareness.

Data Collection

The data for our study was collected using CAWI (Computer Assisted Web Interviewing) via the CryptoRefills platform. This platform facilitates the use of cryptocurrencies, such as Bitcoin, for obtaining gift cards from well-known global brands and mobile operator credits.

Participation in the survey required a transaction history on CryptoRefills, ensuring that insights were drawn from genuine users with experience in cryptocurrency transactions. The survey itself was hosted on Google Forms.

Sample Size

In the period between June 3rd 2023, and September 3rd 2023, 547 responses were collected from survey participants. After meticulous preprocessing to eliminate duplicates, the dataset was narrowed down to 516 unique responses. This refined dataset corresponds to the same timeframe in which 7,535 distinct customers engaged in transactions. To gauge the accuracy of our sample in relation to the broader population of unique customers, the margin of error (MOE) was calculated at a 95% confidence level, yielding an estimate of approximately ±4.16%.

Survey Design

The survey was meticulously structured by CryptoRefills, comprising 145 multiple choice questions divided into distinct sections. This segmentation ensured a comprehensive exploration of respondents’ behaviors, demographics, and perceptions. The questions are designed based on theoretical constructs like TAM2 (Technology Acceptance Model 2) and CryptoRefills’ insights on factors influencing cryptocurrency shopping adoption. The survey covers areas such as demographics, cryptocurrency familiarity, shopping preferences, and constructs from TAM2 like perceived ease of use, usefulness, social norms, usage intentions, and current cryptocurrency usage dynamics.

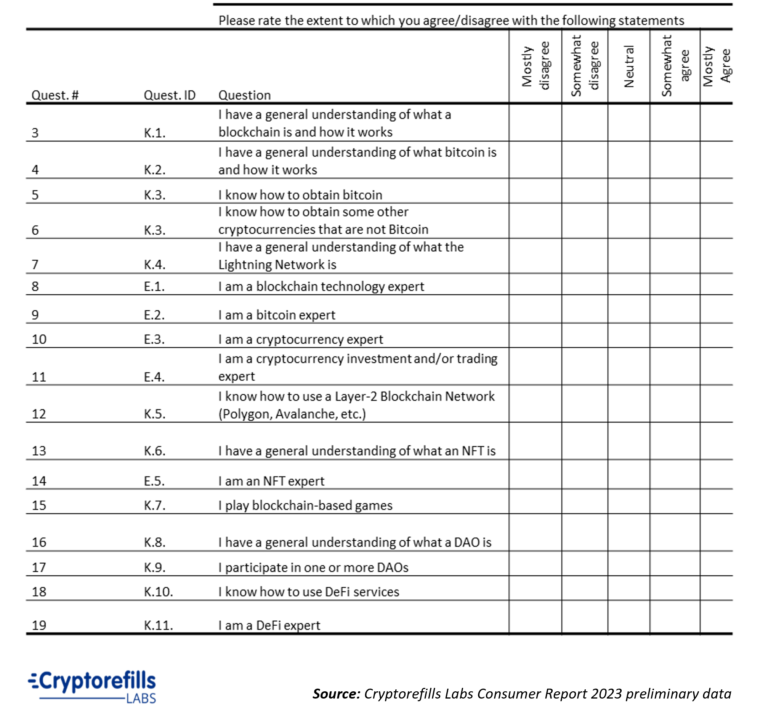

This study focuses on 17 questions pertaining to knowledge and expertise, as outlined in Table 1. These questions employ a 1 to 5 Likert scale, prompting respondents with “Please indicate your level of agreement/disagreement with the following statements.” An example statement is “I am a bitcoin expert,” with response options spanning from “Mostly disagree” to “Mostly agree,” passing through “Somewhat disagree,” “Neutral,” and “Somewhat agree.” The frequency of purchases using cryptocurrency was determined via the survey question: “How often do you purchase products and/or services using bitcoin or other crypto?” Respondents could select from five options: “Almost never,” “At least once a year,” “At least once a month,”, “At least once a week”, “More than once a week or daily”.

Table 1: Survey Questions (Part of Cryptorefills Labs 2023 survey)

Analysis

The analysis began with the preprocessing of the survey data to ensure its validity, reliability, and consistency. This involved removing duplicate entries, transforming categorical responses to numerical values, and performing tests on reliability of the data. This study relies on Cryptorefills’ team managerial and technical experience to ensure data validity. Cronbach’s alpha test was instead conducted to verify data reliability, obtaining a score of 0.967, thus indicating a very high level of consistency.

For the primary analysis, descriptive statistics were employed to provide a comprehensive overview of the knowledge and expertise levels of cryptoshoppers. This allowed to ascertain the distribution, central tendencies, and variability of the responses.

Multiple regression analyses to address the research question probing the relationships between knowledge, expertise, and purchase frequency. This quantitative technique helps determine the strength and directionality of these relationships and to gauge the significance of individual predictors.

Furthermore, cluster analysis was conducted in order to segment the crypto-shoppers based on their knowledge, expertise, and shopping behaviors. This involved using the k-means clustering technique, initially determining the optimal number of clusters using the Elbow method. The clusters obtained provided insight into distinct groups of crypto-shoppers with shared characteristics.

Throughout the analysis, the validation of the results was ensured through appropriate diagnostic tests.

Finally, the findings were also visualized using a variety of graphical tools to enhance clarity and facilitate interpretation. This included bar charts, scatter plots, and radar plots, among others.

Results

Descriptive Statistics

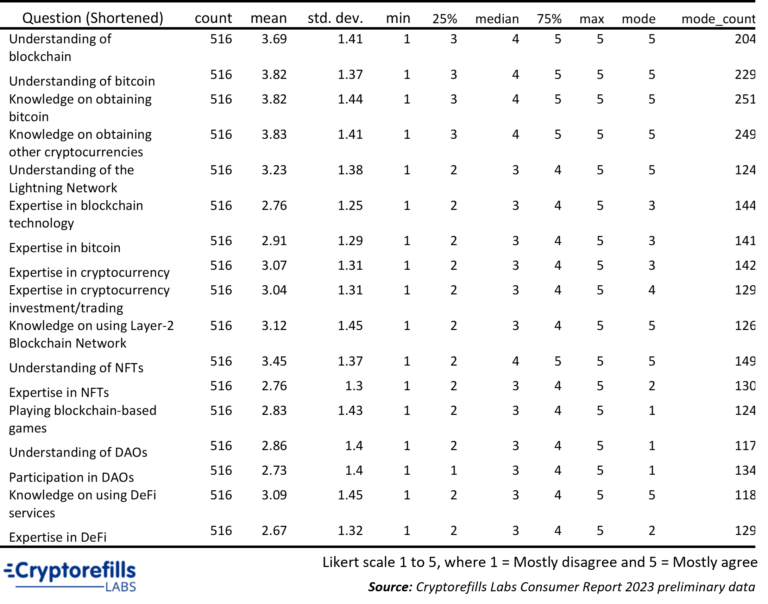

The descriptive statistics data (Table 2) provides insights into respondents’ levels of knowledge and expertise in various areas of blockchain and cryptocurrency. The Likert scale responses, ranging from 1 (indicating low knowledge or disagreement) to 5 (indicating high knowledge or agreement), were assessed to determine central tendencies and dispersion.

Table 2: Descriptive statistics for knowledge and expertise levels and purchase frequency of cryptoshoppers

Most of the respondents have a strong grounding in the basics of cryptocurrency, with high average ratings on understanding both blockchain and bitcoin. Specifically, the average understanding of blockchain stands at 3.69 out of 5, and for bitcoin, it’s slightly higher at 3.82. Moreover, a notable majority claim a deep understanding, with both areas having the highest rating of 5 as the most frequent response.

However, going deeper into more specialized areas of the crypto world, the level of understanding and expertise begins to vary. Understanding of the Lightning Network averages at 3.23, while expertise in blockchain technology dips to an average of 2.76. The expertise in bitcoin and other cryptocurrencies hovers around the 3-mark, suggesting a moderate level of expertise among respondents.

NFTs, or Non-Fungible Tokens, present another interesting case. While the average understanding is a respectable 3.45, the expertise in NFTs is only 2.76, indicating that while many are aware of what NFTs are, fewer feel confident in their deep knowledge about them. Similarly, for DAOs (Decentralized Autonomous Organizations), the understanding is moderately rated at 2.86, but it’s interesting to see that the lowest score is the most common response. A significant subset of the respondents is therefore unfamiliar with DAOs.

Regarding the use of crypto in gaming and DeFi services, the average ratings are 2.83 and 3.09, respectively. For both, there seems to be a spread in the knowledge levels, with ratings ranging from low to high.

This first observation of the levels of knowledge and expertise suggests a decent understanding of cryptocurrency basics among most respondents. However, as the topics become more specialized, there’s a noticeable drop in both understanding and claimed expertise.

The varied responses on topics like NFTs, DAOs, and DeFi highlight fragmented levels of specific areas of the crypto landscape. While many are well-versed in foundational concepts, the ecosystem is rapidly growing and diversifying, leading to varied knowledge levels in these emerging areas.

When it comes to purchase frequency the mean stands at 3.26 meaning that respondents tend to make cryptocurrency purchases around once a month. Three is also the most common response (mode). The 25th percentile at 3 means that at least a quarter of the respondents purchase with crypto once a month, and the 75th percentile at 4 means that the top quarter of respondents shops at least one a week with cryptocurrency.

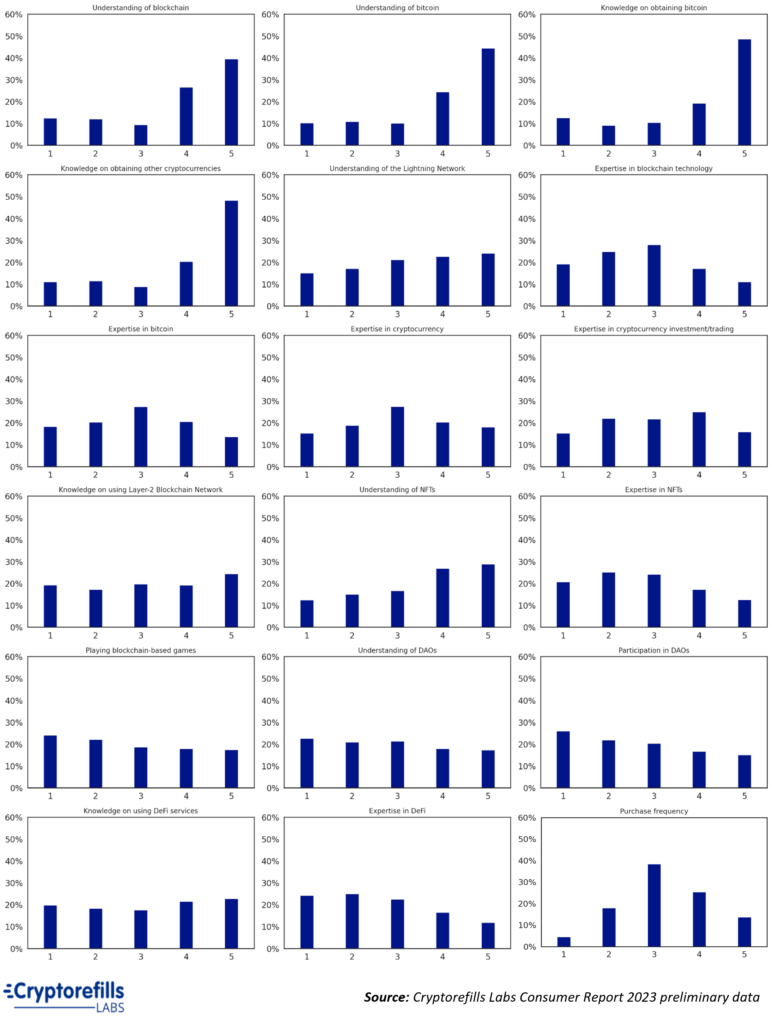

Charts and visual analysis

The distribution charts (fig 1) confirm the first observations. The distribution of knowledge and expertise in various cryptocurrency areas shows a skew towards higher levels of understanding for fundamental topics. For example, the respondents’ understanding of what a blockchain and bitcoin are leaned heavily towards the higher ratings, with peaks observed around the maximum score. However, observing more niche areas like the Lightning Network or specific expertise in DeFi, the distribution broadens, with more respondents clustering around the middle scores, indicating a moderate level of confidence.

Figure 1: Distrbution of knowledge, expertise and purchase frequency levels

The distribution pertaining to engagement with specialized cryptocurrency applications or governance models, such as DAOs and blockchain-based games, shows a different trend. Here, peaks are observed towards the lower end. This pattern is in contrast with the high understanding levels observed for primary topics, indicating a potential gap between knowledge and actual application or participation in some of these more advanced areas. The distribution chart for cryptocurrency purchase frequency demonstrates a strong central tendency. The majority of the participants reported using cryptocurrency for transactions around once a month, as shown by the peak at that frequency. While there were respondents at the extremes (those who use cryptocurrency almost never or daily), they were considerably fewer in number. The shape of this distribution suggests that while daily usage of cryptocurrency for purchases is not the norm, a significant portion of the respondents are neither strangers to it; they use it with a moderate, monthly and often even weekly frequency.

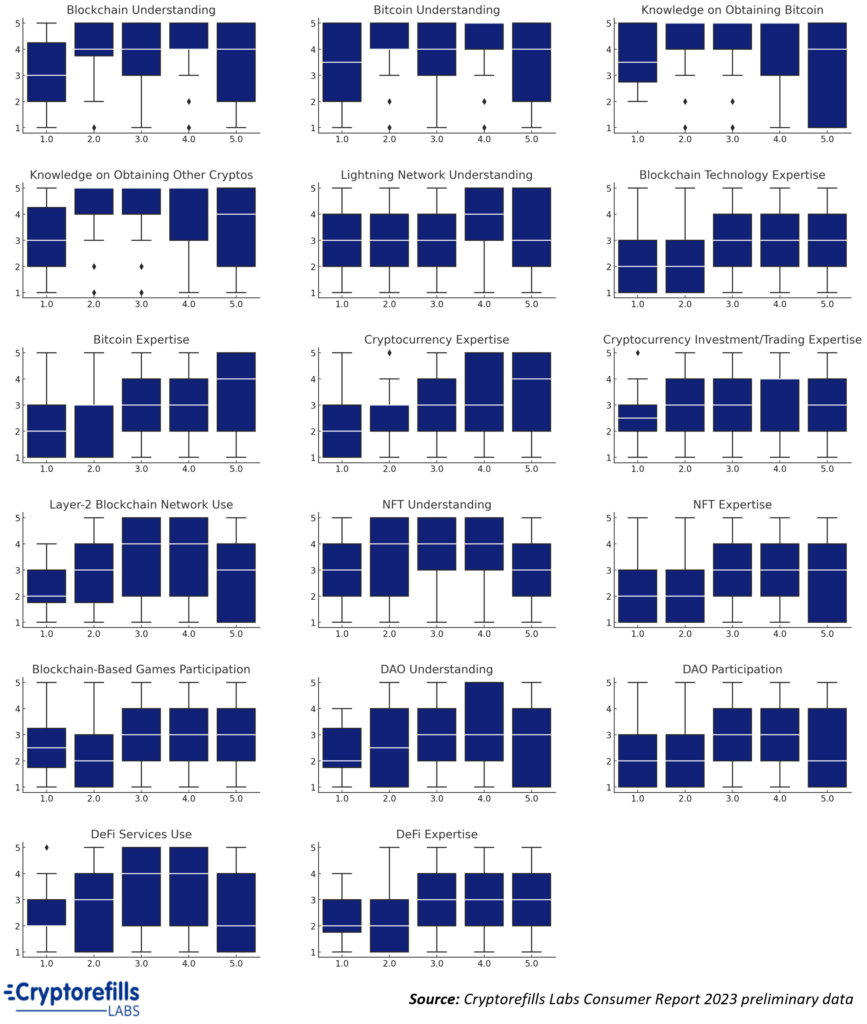

The box plots (Fig.2) visually compare knowledge and expertise ratings against the frequency of cryptocurrency usage for shopping purposes. One clear trend is the upward shift in medians for foundational topics among respondents who shop weekly with cryptocurrency. For instance, those with a weekly shopping frequency exhibit higher quartiles in their understanding of bitcoin, reflecting the median value of 4.0. Additionally, in more specialized knowledge areas, the interquartile range is expansive, suggesting a broader spectrum of expertise among those respondents. The presence of outliers, especially in areas like NFT expertise, highlights that certain respondents possess exceptionally high or low knowledge levels compared to the majority.

Figure 2: Box plot of frequency of purchase in relation to different aspects of knowledge and expertise in the blockchain and cryptocurrency domain

Correlation and Regression

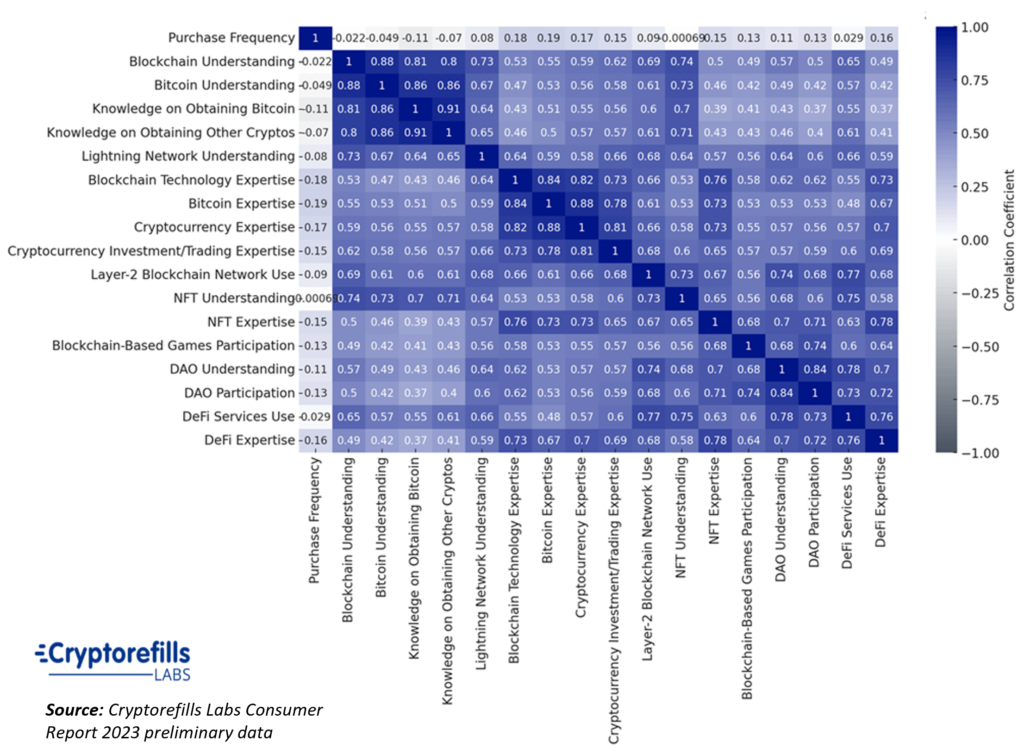

The correlation and regression analysis aimed to determine the relationship between respondents’ knowledge and expertise in various areas of blockchain and cryptocurrency and their purchasing behavior using bitcoin or other cryptocurrencies.

The correlation matrix (figure 3) reveals negative correlations between purchase frequency and all knowledge variables. The strongest negative correlation is with “Knowledge on Obtaining Bitcoin” (-0.11). This suggests that as knowledge or expertise in a specific area increases, the purchase frequency slightly decreases, but the correlations are generally weak..

Figure 3: Correlation matrix and heatmap between the knowledge and expertise and purchase frequency variables of cryptoshoppers

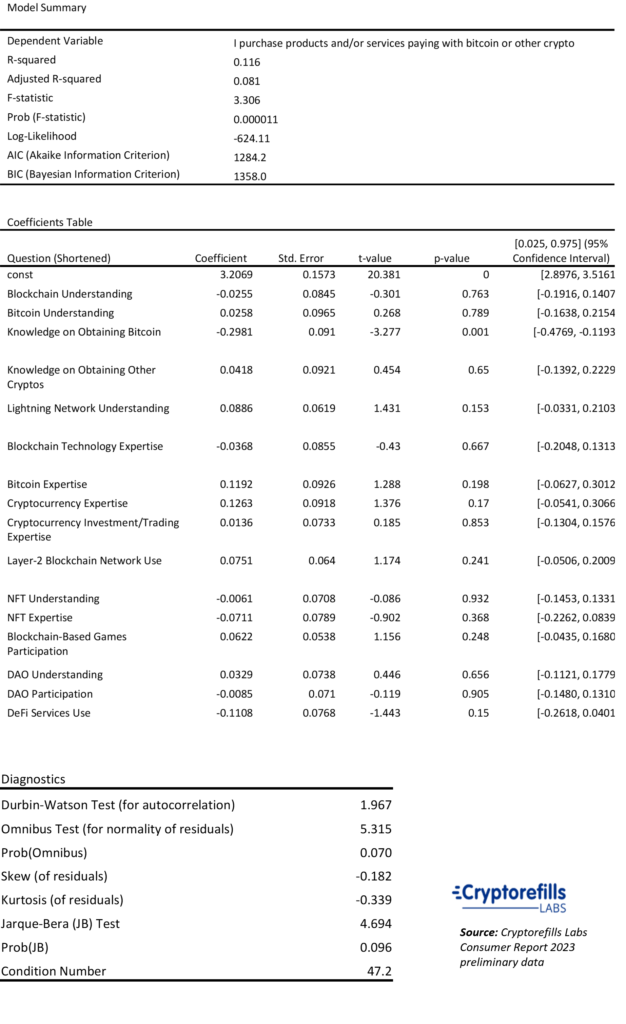

The regression model (Table 3) explains about 11.63% of the variance in the dependent variable, as indicated by the R-squared value (0.116). The adjusted R-squared (0.881), which takes into account the number of predictors, is slightly lower at 8.11%. The F-statistic is 3.31, and its associated p-value is significantly small (p<0.001), suggesting that the model is statistically significant. The overall model’s explanatory power is therefore significant but quite limited given the low R-squared values.

Table 3: Rgression analysis

Upon analyzing the individual predictors of the regression model, only “Knowledge on Obtaining Bitcoin” is statistically significant (p-value = 0.001) with a negative coefficient. This implies that for each unit increase in knowledge about obtaining bitcoin, the purchase frequency decreases by about 0.2981 units, holding other variables constant. The other predictors were not statistically significant, suggesting that individually, they don’t have a strong linear association with purchase frequency.

The diagnostics suggest that the assumptions of the regression model are reasonably met with Durbin-Watson close to 2 indicating no autocorrelation, and skewness and kurtosis values close to what’s expected for normally distributed data.

Therefore, crypto-shoppers’ knowledge levels have a minor negative link with their buying habits, with greater knowledge about obtaining bitcoin leading to fewer purchases. However, this knowledge only explains about 11.6% of purchase frequency variations, indicating other significant factors influence crypto buying behavior not covered in this model.

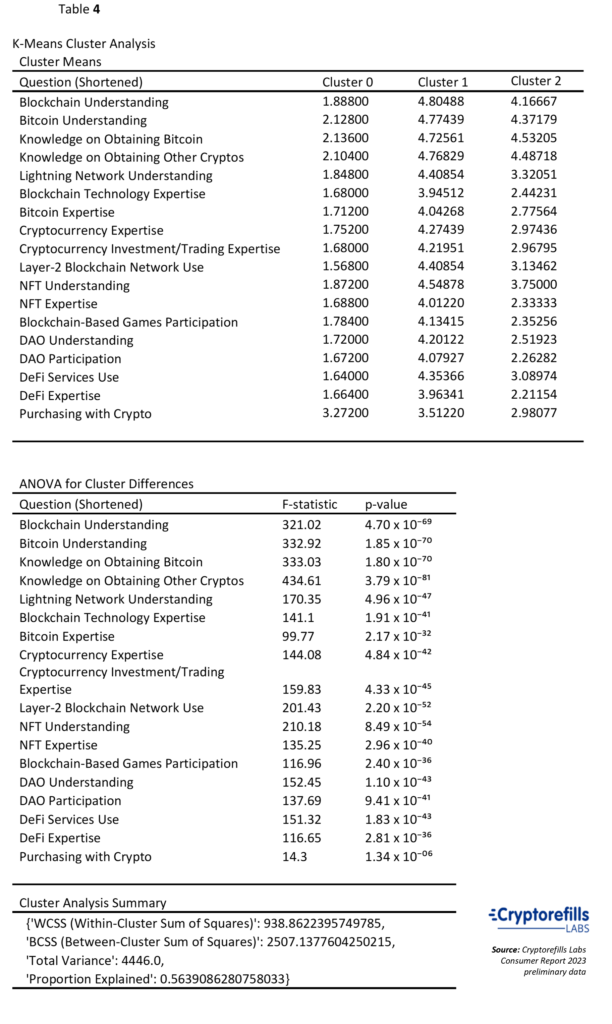

Cluster Analysis

A k-means cluster analysis was undertaken to understand the different levels of blockchain knowledge among respondents. Based on the elbow method it was thought that three or four clusters would be ideal. After running the analysis for both three and four clusters the three-cluster solution was selected. The k-means clustering results (table 4) indicate that a 3-cluster solution provides more distinct and well-defined groupings compared to a 4-cluster solution.

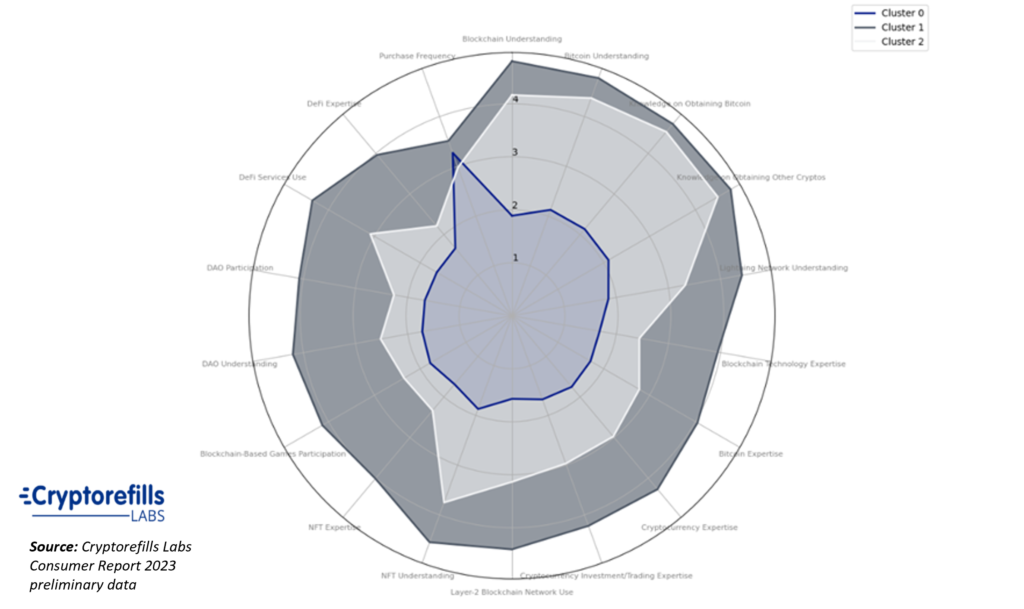

Notably, the 3-cluster setup showcases clearer differentiation, especially with the low-knowledge group standing out (Figure 6). Key clustering metrics further support the 3-cluster model to be more adequate as it boasts a higher silhouette score (indicating better-defined clusters), a lower Davies Bouldin score (suggesting better separation between clusters), and a higher Calinski Harabasz score (indicating tighter clusters).

Following is a description of the three clusters:

· Cluster 0 – Low Knowledge Group (28.09% of population): This group displays a minimal understanding of cryptocurrency and related technologies. Their comprehension of foundational topics like blockchain and bitcoin hovers around 1.8 to 2.1, which suggests a basic or rudimentary grasp. As the topics become more specialized, such as the Lightning Network or Layer-2 Blockchain Networks, their knowledge remains low. Their self-assessed expertise in specific domains, such as being a blockchain or bitcoin expert, is also low, generally remaining below 2. This indicates limited confidence in their proficiency. Despite their lack of in-depth knowledge, they are quite active in the crypto market with a purchase frequency rating of around 3.27.

· Cluster 1 – Expert Group (35.06% of the population): This cluster consistently shows a comprehensive understanding of crypto topics. Basic concepts like blockchain and bitcoin have ratings close to 4.8, indicating a very strong foundation. Their understanding also extends to more niche areas like DeFi and NFTs, with ratings above 4. They also perceive themselves as experts in various domains, with ratings generally exceeding 4. This suggests high confidence in their abilities and possibly extensive experience in the crypto realm. They also rank high (around 4) in specific practical uses of the blockchain and crypto domain such as participating in DAOs, blockchain games and use of DeFi services. Their purchase frequency, at around 3.51 is slightly higher than the Low Knowledge Group.

· Cluster 2 – Moderate Knowledge Group (36.85% of the population): Members of this cluster have a fair understanding of cryptocurrency basics, with ratings around 4.2 for blockchain and bitcoin. However, as topics become advanced, their knowledge declines but remains above average, indicating a more than basic grasp but not at an expert level. In fact they rate themselves moderately in specialized areas. For instance, while they might understand what an NFT is, they don’t necessarily see themselves as NFT experts, with ratings around 2.33. Their purchase frequency is around 2.98, which is slightly lower than the other groups.

Discussion

This section addresses the research questions using the findings from the analysis. The results are compared with existing literature to understand their place within the wider cryptocurrency ecosystem. As the digital economy evolves, it’s important to examine the relationships between individual knowledge, expertise, and the larger trends in cryptocurrency use.

Discussion of major findings

RQ1 Levels of knowledge and expertise among crypto shoppers

In answering the research question regarding the detailed descriptions of knowledge and expertise levels among crypto shoppers, this study a comprehensive picture that aligns, extends, and sometimes challenges the existing literature.

Alqaryouti et al. (2020) emphasized a robust understanding of cryptocurrency among its interviewees, a sentiment echoed in our data. The median scores for understanding both blockchain and Bitcoin lie at 4 on a scale of 1 to 5, pointing to a significant familiarity among crypto shoppers. These high median scores further reinforce the findings of the Cryptorefills Labs reports of 2021 and 2022, where most crypto consumers were noted to recognize basic blockchain and cryptocurrency concepts. However, the data suggests a nuance when it comes to expertise. The median scores for “Expertise in Blockchain technology”, “Expertise in Bitcoin”, and “Expertise in Cryptocurrency” are 3, 3, and 3, respectively, suggesting that while many have a basic grasp of the subject matter, most are not classifiable as blockchain or crypto experts.

When considering the metrics for “Understanding of blockchain” and “Understanding of bitcoin”, a notable portion of respondents, approximately a third, have rated their knowledge at lower levels (either 1 or 2). This observation suggests that a significant number of crypto shoppers use cryptocurrencies for transactions even without an understanding of the underlying technology. This scenario is interesting from an adoption standpoint, and maybe indicating that adoption could be spreading from the blockchain domain enthusiasts and experts to those to which it resolves practical needs and that don’t need to or are not interested in understanding the technology and its financial implications.

The knowledge of the payment technologies that are considered the key enablers of blockchain payment scalability, that is Lightning Network and Layer-2 Blockchain is moderate (both with a median score of 3). These have lower average ratings compared to general blockchain understanding, suggesting that these concepts are more specialized and understood primarily by those with higher expertise. Or that have a stronger need to use them for practical reasons.

The median value for “Understanding of NFTs” is 4 (with a mean of 3.45). When comparing this to foundational topics like “Understanding of blockchain” (median: 4, mean: 3.69) and “Understanding of bitcoin” (median: 4, mean: 3.82), it’s evident that the understanding of NFTs is not far behind. This is noteworthy considering NFTs are a more recent and niche phenomenon in the crypto space. The mode for “Understanding of NFTs” is also 5, indicating that a significant portion of respondents rated their understanding as very high, further emphasizing its growing prominence among crypto-shoppers.

Also the implicit knowledge acquired by crypto-shoppers from participation in blockchain enabled applications and services is significant. For “Participation in DAOs,” the median is 3, (with a mean of 2.73), while “Playing blockchain-based games” has a median of 3 (and a mean of 2.83). “Knowledge on using DeFi services” exhibits a median of 3 and a mean of 3.09. Knowledge on using DeFi services also stands out with the highest mean in terms of usage of blockchain enabled services, suggesting that crypto-shoppers are more familiar with decentralized finance (DeFi) services compared to other applications like DAOs or blockchain gaming. The mode for “Knowledge on using DeFi services” is also 5, further indicating that a significant portion of respondents are well-acquainted with DeFi applications.

RQ2 Correlation knowledge and expertise with purchase frequencies

The CryptoRefills Labs Reports (Çabuk & Silenzi 2021, 2022) does not offer any insights or data on the relationship between knowledge and expertise level and their role in crypto shopping. The correlation analysis and regression model in this study offers quantitative insights that are integral to understanding if such relationship exists and the nature of such relationship.

The analysis indicates a there are weak negative correlations between all knowledge variables and purchase frequency, with the most notable being “Knowledge on Obtaining Bitcoin” (-0.11). This suggests that increased expertise in certain areas, particularly in obtaining Bitcoin, is associated with a slight decrease in purchase frequency. However, these correlations, while statistically significant, are weak. The regression model reveals that knowledge levels explain only about 11.6% of the variance in purchasing behavior, pointing to other influential factors not covered in the model.

The model suggests that of the 17 different variables studies, only knowledge in obtaining bitcoin can be considered a statistically significant predictor of purchase frequency. The model in fact suggests that a unit increase in knowledge about obtaining Bitcoin corresponds to a decrease in purchase frequency by 0.2981 units. This is quite interesting in relation to Satoshi Nakamotos’s vision for Bitcoin as digital cash and might entail that crypto shoppers more knowledgeable in obtaining bitcoin share the (quite popular) belief of Bitcoin as a form of store of value or long term investment, and as such don’t want to spend it.

Other knowledge factors did not show significant associations with purchase frequency. In essence, while there’s a minor link between domain knowledge and purchase habits, it’s limited in its explanatory power, hinting at other influential factors in crypto purchasing behavior beyond the findings of the CryptoRefills Labs reports.

While crypto-shoppers generally possess significant knowledge, the relationship between this knowledge and purchase frequency is weak and this analysis reveals that expertise is not a strong predictor of shopping frequency with crypto. This suggests that frequent crypto shopping can be adopted by a wide range of individuals, from experts to novices, regardless of their depth of understanding.

RQ3. Knowledge and Expertise Based Segmentation

Throughout the years, the cryptocurrency sector has drawn a myriad of users, each with varying degrees of knowledge and expertise, especially among those who utilize crypto for shopping. The reports by Cabuk & Silenzi (2021, 2022) provided a first segmentation of global crypto-shoppers. This analysis aimed to further dissect this cohort but only in terms of their levels of knowledge, expertise and purchasing frequency. The primary objective was to ascertain whether specific groups or clusters of crypto-shoppers could be identified based on their knowledge, expertise, and shopping behaviors, and, if identified, if these clusters varied in their crypto-shopping patterns.

Upon employing the K-Means clustering technique, three distinctive clusters of crypto-shoppers were identified. Cluster 0 (The Low Knowledge Group) at 28.09% showcase low knowledge rates across the board; Cluster 1 (The Experts) at 35.05%, possess strong knowledge and strong levels of expertise across the general crypto domain as well as specific technical, financial and practical applications of blockchain such as DAOs, NFTs and Defi; and Cluster 2 (The Moderate Knowledge Group) at 36.85% that shows a decent foundational understanding of the domain but lower levels of expertise and practical know how in specific areas such as Defi, DAOs and Layer 2s. The ANOVA results offer statistical significance to the distinctions observed in the clusters (nearly all variables exhibit significant F-values with p-values < 0.001, indicating that the means of these variables significantly differ across the clusters) underscoring the robustness of the cluster differentiation.

Interestingly when analyzing these groups it is possible to observe an interesting dichotomy in the Low Knowledge group: Representing roughly 28% of the population, their foundational knowledge about blockchain and bitcoin is minimal, suggesting they are either new to the sector or simply not engaged with the deeper technical facets of the blockchain and crypto world. Yet, despite this apparent lack of depth, they are surprisingly active in the crypto market, with a purchase frequency that’s comparable to the Expert Group. This could suggest a few things. The barrier to entry in the crypto shopping world might be lowering, allowing even those with limited knowledge to participate actively. Also, the motivation of this group to shop with crypto might be driven more by external factors (like economic benefits, peer influence, or the appeal of using modern technology) more than by a deep understanding of the technology itself. This group’s behavior also resonates with Alqaryouti et al.’s (2020) observation that many users appreciate cryptocurrency for its transactional advantages, not necessarily its technical underpinnings. The high purchasing frequency, despite limited expertise, suggests that the allure of crypto’s benefits like decentralization and cost-efficiency can supersede the need for deep understanding.

The Expert Group, with their self-rated strong knowledge and confidence in crypto topics display the highest purchase frequency among clusters. However, the minor frequency difference with the Low Knowledge Group implies knowledge is clearly not the only purchase driver. The Moderate Knowledge Group instead shows the lowest purchase frequency, hinting maybe interest in the sector but a more cautious approach.

The differences in crypto shopping frequency across the three groups, while appearing minimal statistically, do present some substantial practical implications given the categorical nature of the question (normalized for the purpose of this analysis). A score of 2.98 for the Moderate Knowledge Group translates to shopping roughly once a month. In contrast, the 3.51 score for the Expert Group indicates shopping several times a month, although not consistently every week. Therefore, despite it being minimal from a statistical point of view, there is a decent variation in shopping behavior and frequency between the clusters, a gap between monthly and near-weekly shopping habits.

Business & Managerial Implications

The findings from in this research provide a more nuanced and detailed understanding of crypto shoppers, revealing patterns of knowledge, expertise, and shopping behaviors and may have several implications for businesses accepting cryptocurrency payments. By reviewing the major findings, it is possible to extrapolate potential strategies and areas of focus that could drive growth, customer engagement, and innovation in this rapidly evolving market.

1. Expanding Acceptance: The high purchasing frequency of “Low Knowledge Users”, despite their limited expertise, suggests a significant market potential for businesses that accept crypto payments. This confirms other findings of the Cryptorefills Labs report that covers specific demographics that are financially excluded, live in fragile economies with high inflation or financial instability or have other needs. Also, newer technologies and applications, easier to use, such as next generation wallets, improved user experience and education offered by companies in the sector may be facilitating adoption to the wider market. Since the Low Knowledge Users tend to spend very frequently, on average once a month or more and likely represent a good portion of the newer adopter cohorts this segment also represents an interesting target for companies offering crypto payments and wishing to expand their customer base.

2. Segmented Marketing and Education: The clear segmentation of crypto-shoppers into distinct clusters based on their knowledge levels suggests that businesses in the crypto space may tailor their marketing and educational campaigns. For instance, “The Experts” might value advanced tools and features, while ‘The Low Knowledge Users’ could benefit from simplified user interfaces and educational content that underscores the practical benefits of crypto.

3. Marketing acquisition channels: The practical knowledge levels among respondents, such as a significant number agreeing to be engaged in blockchain gaming (35.27%), participating in DAOs (31.78%), or possessing expertise in trading, DeFi (28.29%), and NFTs (29.84%), signal emerging avenues for advertising and marketing strategies. Businesses can therefore craft targeted partnerships, promotions and campaigns targeting the above channels to entice and acquire customers more inclined to transact with cryptocurrency.

4. Pricing & Payment Customization: Stores accepting cryptocurrency can enhance user experience by customizing pricing and payment aspects based on user expertise. For instance, offering advanced payment options such as innovative layer 2 protocols that require more complex to use crypto wallets for ‘The Connoisseurs’, while providing streamlined, easy-to-navigate options for ‘The Practical Users’ so they can easily pay from the account held on the exchange or from widely adopted and easy to use crypto wallets.

5. Re-assessing Knowledge Assumptions: The fact that “The Low Knowledge Users” shop with crypto frequently, despite limited expertise, challenges the conventional belief that deeper knowledge naturally leads to adoption. Businesses should ensure they don’t alienate potential customers by overestimating the required knowledge base for crypto transactions.

6. Enhancing Trust: Given the varying levels of expertise, especially among “The Moderate Knowledge Group” and “The Practical Users”, businesses might need to emphasize security and trust. Simplified explanations about security protocols, user-friendly guides, and transparent practices can enhance trust among less knowledgeable users.

Limitations

Every research study has its limitations, and this study is no exception. Although the sample is quite ideal with an MOE under 5% (at 95% CI), the responses may not fully capture the diverse range of knowledge levels and real purchase frequency of crypto shoppers, due to these limitations:

· Self-reported Data: The survey relies on self-reported data, which can sometimes be influenced by recall bias, social desirability bias, or misinterpretations of questions. The self-perceived expertise may not align entirely with objective measures of knowledge.

· Incentive Bias: Although the incentive was carefully designed to be appealing without exerting undue influence, there’s always a possibility that it might have subtly influenced participation and responses.

· Geographical and Demographic Bias: The data is sourced from CryptoRefills customers, which might not be representative of the broader global cryptoshopper population. The study might have inherent biases based on the platform’s user demographics and geographical reach.

· Cross-sectional Data: The data is cross-sectional, taken at a specific point in time. Cryptocurrency is a rapidly evolving domain, and behaviors and knowledge levels might change over time. Longitudinal studies could offer deeper insights into how these aspects evolve.

· CAWI Limitations: The Computer Assisted Web Interviewing (CAWI) method, while efficient, might exclude potential respondents who prefer other modes of surveying or those who face technical challenges.

· Potential Non-response Bias: Not every customer approached might have responded to the survey. There could be inherent differences between respondents and non-respondents that might influence the results.

· Single Platform Data Source: All data comes from a single platform, CryptoRefills. While this ensures consistency, the behaviors and knowledge levels of users on this platform might differ from those on other platforms.

Future areas of research

The results of this study have shed light on several aspects of crypto-shoppers’ knowledge and behavior. However, as with all research endeavors, new questions arise even as old ones find their answers. In this vein, we identify several promising avenues for future research.

Firstly, this study primarily focuses on individuals who already shop with crypto. Yet, it’s essential to recognize that these crypto shoppers represent only a fraction of the estimated 420 million crypto users globally. A logical progression would be to investigate the knowledge and expertise levels of a broader spectrum of crypto users. This could encompass those who hold cryptocurrencies but refrain from shopping with them, those familiar with the concept but haven’t ventured into its acquisition, and even the general populace. Such an expansive survey could offer richer insights into the role of knowledge and expertise vis-à-vis crypto adoption.

Another potential area of investigation lies in examining how knowledge interfaces with other determinants of behavior. While this study dives deep into the realm of knowledge, understanding its interplay with factors such as perceived ease of use, usefulness, trust, and perceived risks could paint a more holistic picture. This would provide a comprehensive view of the myriad factors influencing crypto shopping dynamics.

The current study expanded the knowledge and expertise variables to 17, providing a granular understanding. However, employing techniques like factor analysis could help consolidate these into fewer, more overarching constructs. This exercise can simplify interpretations and potentially reveal underlying structures in respondents’ crypto perceptions.

From a theoretical standpoint, our empirical findings could be juxtaposed against established frameworks in the realm of technology adoption. Models like the Technology Acceptance Model (TAM) and its evolutions TAM2 etc. might find both resonance and divergence with the results in the specific context of cryptocurrencies. Such a theoretical exploration could further academic discourse in the domain.

Considering the fluid and rapidly evolving nature of the cryptocurrency space, a longitudinal approach could be particularly enlightening. Tracking knowledge, expertise, and behaviors over time would capture the dynamism inherent in this digital landscape, offering a temporal perspective on its evolution.

Beyond quantitative surveys, qualitative endeavors such as in-depth interviews could offer a richer tapestry of insights. Personal narratives, motivations, hesitations, and experiences could provide the depth and context often elusive in numeric data.

Furthermore, the principles of behavioral economics, with its focus on cognitive biases and heuristics, could be a fascinating lens to apply to crypto behaviors. By probing into the rational and often irrational patterns of crypto adoption and usage, we might uncover layers of psychological complexities at play.

Lastly, in a domain where the digital intertwines with finances, trust is paramount. Future research could delve into how trust is established, maintained, or broken in the crypto world. Factors like security perceptions, past experiences with scams or hacks, and the role of crypto platforms could be pivotal in this exploration.

Conclusions

The cryptocurrency domain, with its intricate nuances and rapid evolution, presents a detailed description the blockchain domain knowledge and expertise levels of those consumers making commercial transactions with cryptocurrency as well as describing their purchase habits in terms of frequency. This study aimed to shed light on these dimensions, building upon the foundation set by the CryptoRefills Labs reports.

The findings of this research offer a more detailed understanding of the crypto shopper landscape in terms of their knowledge and expertise levels. While a majority of crypto-shoppers (close to 70%) do have foundational knowledge or general understanding of the blockchain / crypto domain, only about one third consider themselves expert. Interestingly many crypto-shoppers are actively involved in the sector, using Defi services, playing blockchain games, or participating in DAOs and this may represent an interesting marketing avenue for those companies offering cryptocurrency as a payment option. Interestingly, about a third of those shopping with cryptocurrency don’t agree to having even a general understanding of blockchain, bitcoin or cryptocurrency and this might indicate that adoption is reaching wider population segments, and is driven by practical needs that go beyond the enthusiasm and participation in the new technology sector such as a means for financial inclusion.

This study also examines the relationship between knowledge and purchase frequency. The correlation and regression models tell us that that not only there isn’t a need to be knowledgeable of the cryptocurrency domain to be a shopper, but that increasing levels of knowledge and expertise don’t increase the spending frequency of the consumer. On the contrary, the relationship is very slightly negative, especially when it comes to knowledge in obtaining bitcoin, maybe suggesting the use for savings and store of value of this specific yet most popular cryptocurrency.

The segmentation into distinct clusters—ranging from shoppers with minimal or no knowledge to the Experts—underscores the varied expertise levels and behaviors of crypto shoppers. Each segment, with its unique set of characteristics, emphasizes the non-uniform nature of the crypto shopper profiles. This offers interesting avenues for businesses offering crypto payment options to their customers to explore for marketing purposes, as well as for defining optimal user experiences based on knowledge levels.

However, while these findings contribute to understanding the crypto-shopper, it’s crucial to acknowledge the study’s constraints. This research offers a snapshot of the current landscape, but the dynamic nature of the cryptocurrency sector warrants continuous exploration and re-evaluation.

References

Alqaryouti, O., Siyam, N., Alkashri, Z., Shaalan, K. (2020). Users’ Knowledge and Motivation on Using Cryptocurrency. In: Themistocleous, M., Papadaki, M. (eds) Information Systems. EMCIS 2019. Lecture Notes in Business Information Processing, vol 381. Springer, Cham. https://doi.org/10.1007/978-3-030-44322-1_9

Çabuk, U.C., & Silenzi (2021, June). Cryptocurrencies in Retail: Consumer Adoption Report 2021. CryptoRefills Labs. https://doi.org/10.6084/m9.figshare.14790384

Çabuk, U.C., & Silenzi (2022, November). Cryptocurrencies in Retail: Consumer Adoption Report 2022. CryptoRefills Labs. https://doi.org/10.6084/m9.figshare.21628469.v2

Coinmarketcap (n.d.). Cryptocurrency Market. Retrieved 21 August 2023 https://coinmarketcap.com/charts/

Coinmap.org (2023). Map of locations accepting bitcoin. Retrieved 19 August 2023 https://coinmap.org/view/#/world/18.31281085/-116.71875000/2

Davis, F. D. (1985). A technology acceptance model for empirically testing new end-user information systems: Theory and results (Doctoral dissertation, Massachusetts Institute of Technology).

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

Deloitte (2022). Merchants getting ready for crypto: Merchant Adoption of Digital Currency Payments Survey. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology/us-cons-merchant-getting-ready-for-crypto.pdf

Lundvall, B.Å., (2007). Innovation System Research – Where it came from and where it might go. Globelics Working Paper Series 2007-01, Globelics – Global Network for Economics of Learning, Innovation, and Competence Building Systems, Aalborg University, Department of Business and Management.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Decentralized business review.

Regan, M.P., & Hajric, V. (2023, August 18). How can cryptocurrencies play a role in promoting financial inclusion? Bloomberg.

Triple-A. (n.d.). Global cryptocurrency ownership data 2023 – Triple A. Retrieved August 23, 2023 https://triple-a.io/crypto-ownership-data

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management science, 46(2), 186-204.

Wisdom, J.P., Chor, K.H.B., Hoagwood, K.E. et al (2014). Innovation Adoption: A Review of Theories and Constructs. Adm Policy Ment Health 41, 480–502. https://doi.org/10.1007/s10488-013-0486-4

Zhang, D., Sun, Y., Duan, H., Hong, Y., & Wang, S. (2023). Speculation or currency? Multi-scale analysis of cryptocurrencies—The case of Bitcoin. International Review of Financial Analysis, 9(1), 4