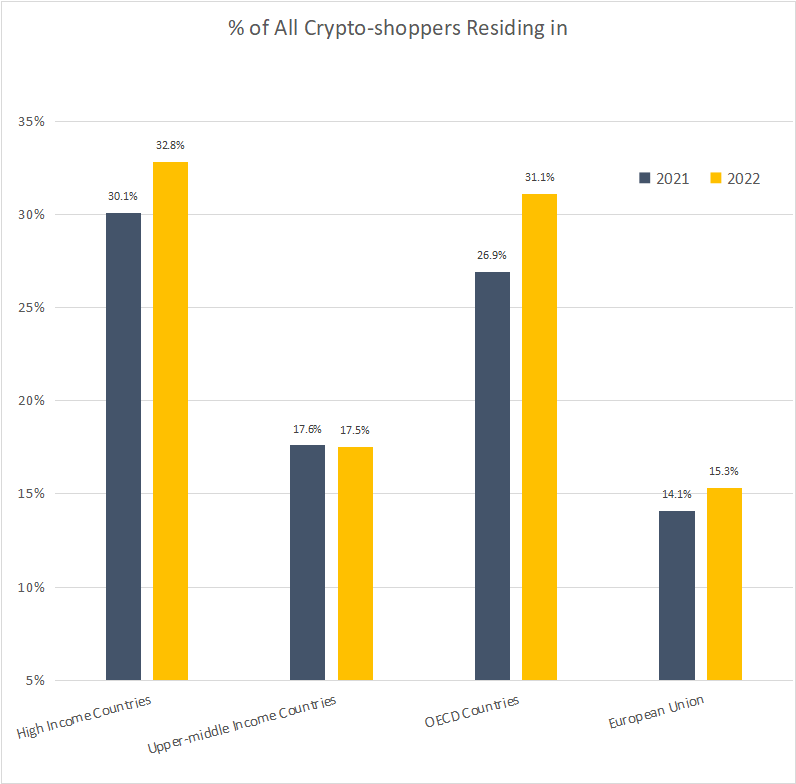

Crypto-shopping is emerging fast in the developed economies

Finally in the third section of the Cluster Analysis we reanalyze some of the most important data and charts of the Consumer Report with respect to the segments identified in the Cluster Analysis. For example, in the Report we analyzed certain preferences or shopping habits such as use of Lightning Network. While in the first part of the Report we provide the reader with a generic percentage of users that have used “Lightning Network” or a certain percentage of shopper that spend Crypto on a monthly basis or certain cryptocurrency preferences, in the third section of Cluster Analysis we will provide these percentages again but split for each segment. In other words, preferences such as use of Lightning Network or type of products purchased with crypto, or habits such as frequency of spending cryptocurrency, are assessed for each individual segment providing. This is very interesting because a certain preference or habit may be much more prevalent with one or more specific segments, and thus can provide actionable marketing data points.

About Cryptorefills

CryptoRefills is on a mission to enable people all over the world to spend bitcoin and other cryptocurrencies for their everyday needs. With CryptoRefills, people from over 150 countries and territories can top up their mobile credit and buy gift cards with bitcoin and other crypto from the world’s largest digital and retail brands. As one of the earliest adopters of the Bitcoin Lightning Network, and as the first company in the world to launch Ethereum layer-2 payments (via Polygon Matic and Arbitrum) and fast finality blockchains (via Avalanche and Fantom) for Ecommerce payments, CryptoRefills is leading the innovation in applied decentralized payments and developing new technologies for the gift card industry.

The Company is also very active in researching and educating on consumer spending of cryptocurrency in retail through its Labs initiative and publishes an annual report on the global use of crypto for purchasing goods and services. CryptoRefills is a fast-growing fintech, headquartered in Amsterdam, and a proud member of the Holland Fintech Association and Blockchain Netherlands Foundation.

Website | Twitter | LinkedIn | For information and press enquiries: media@cryptorefills.com

For information concerning CryptoRefills research and annual report on consumer spending of cryptocurrency in retail: https://labs.cryptorefills.com/